Online smartphone sales grew to 12% of all smartphones sold in the US in Q1 2018, up from 9% a year ago. Carriers’ online portals captured a combined 33% of total online smartphone sales while their physical retail footprint captured three-fourths of the total offline sales. Apple iPhones were the most popular models across both online and offline channels.

San Diego, Buenos Aires, London, New Delhi, Hong Kong, Beijing, Seoul

June 5th, 2018

According to the latest research from the Counterpoint Smartphone Channel Share Tracker service, the share of the online smartphone channels grew to 12% share of the total US smartphone sales in Q1 2018. Despite US consumers being massive online consumers, brick and mortar establishments remain king when it comes to purchasing smartphones. Comparatively, developing markets, such as India, have the highest percentage of smartphones being sold through e-commerce channels (see here). China follows with a slightly lower percentage share of online smartphone sales but is the leading the market in terms of volumes of smartphones sold online globally (see here).

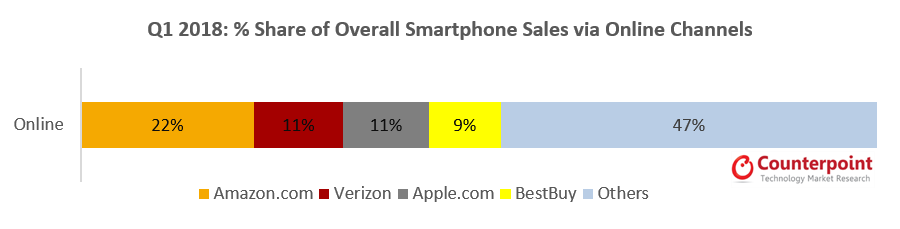

Commenting on the competitive landscape, Research Director Peter Richardson highlighted, “Amazon.com was the leading sales channel in the US contributing to 22% of total smartphones sold online due to a wide portfolio of devices, impeccable customer service, and a growing base of Prime households and Prime smartphone bundles. Among carriers, Verizon was the largest online sales channel with its large tech consumer base, only behind Amazon in terms of total online sales. Apple.com was the third largest online channel capturing just under 11% share of total smartphones sold online in Q1 2018. National retail giant Best Buy followed closely in the fourth position.”

Source: Counterpoint Research – Smartphone Channel Share Tracker Q1 2018

Mr. Richardson added in terms of OEM share, “Apple continued to lead both online and offline sales channels. Samsung had a higher share in offline channels compared to online channels as online sales represent a low percentage of total Samsung smartphone sales compared to Apple. Brands such as BLU, Google, and Huawei have a greater proportion of sales coming from online channels than Samsung. Some niche players such as OnePlus and Huawei (Honor) are strategically selling into the US market via online channels only to avoid expensive investments in offline store fronts.”

Commenting on the US online market dynamics, Research Director Jeff Fieldhack said, “There have been numerous carrier digital initiatives to increase online sales. Despite this push, it remains relatively small compared to offline. More recently with the Samsung Galaxy S9 launch, we saw online pre-orders weaker year-over-year. Carriers and national retailers have large store counts that they are leveraging to get consumers to physically touch and test high-end devices, so they know what they are buying. Stores also provide a better opportunity to up-sell accessories and insurance. This trend will not be going away any time soon. In many cases, carriers are even increasing the number of physical storefronts.”

Fieldhack added, “Another piece slowing down online sales to grow faster like in other economies are the incentives carriers and national retailers are giving for trading in a used device when purchasing a new smartphone. A large majority of subscribers have a comfort level handing over a used device to a carrier knowing it will be sufficiently wiped of all data and disposed of properly.”

Further commenting on the online-offline dynamic, Research Analyst Maurice Klaehne stated, “The smartphone market differentiates itself from other tech markets as people are purchasing a device that they will have on them every day. It is a complicated purchase, as these devices are frequently sold bundled with a plan, service upgrade, or accessories. People often need help in these situations to get their phone set up, data transferred to the new device, and have new features explained. Physical storefronts are critical for carriers to boost consumer experiences and improve customer retention.”

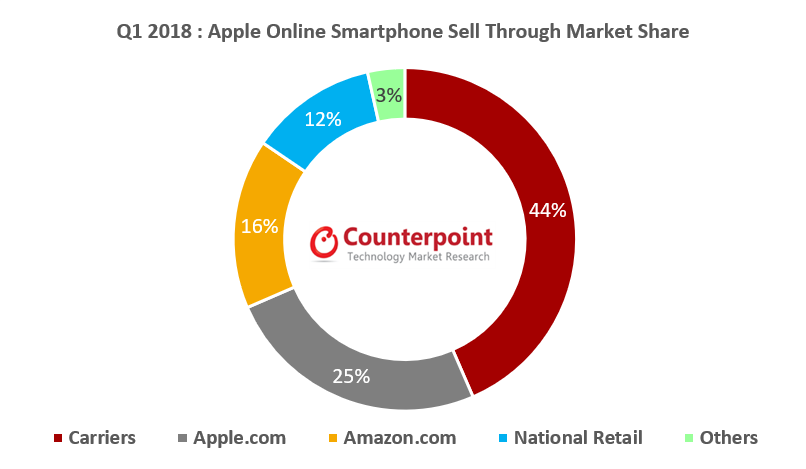

Pointing out market leader Apple’s contribution to this trend, Klaehne added, “Apple registered record first quarter sales with over 16 million smartphones sold (see here) and has been the best-selling brand in online and offline channels. However, in terms of online channels, the Cupertino vendor is still heavily dependent on carrier online channels for sales. Almost half of Apple’s online sales were sold via carrier online channels. One in four online iPhone sales are via Apple.com in the US. This channel is larger than any individual carrier’s e-commerce portal. National retail e-commerce portals from BestBuy, Walmart, Target, and others’ make up a combined 12% of iPhone online sales.”

Source: Counterpoint Research – Smartphone Channel Share Tracker Q1 2018

This is an excerpt from our smartphone channel share tracker service across different geographies providing highly detailed insights and analysis – answering the why, backed by solid granular sales database mapped across different channels – offline and online.

Background:

Counterpoint Technology Market Research is a global research firm specializing in detailed industry analysis of the TMT sectors. It services major technology firms and financial firms with a mix of monthly reports, customized projects and detailed analysis of the mobile and technology markets. Its key analysts are experts in the industry with an average tenure of over 16 years in high tech industries.

Analyst Contacts:

Jeff Fieldhack

+1 858 603 2703

jeff@counterpointresearch.com

Maurice Klaehne

+1 617 336 8383

maurice@counterpointresearch.com