Marc Andreessen’s famous quote from the last decade, “Software is eating the world”, was right on the money. However, the game has changed this decade – now “Data is eating the world”. Eight out of the world’s top ten companies in terms of market cap, including Apple, Alphabet, Microsoft, Facebook and Alibaba, have seen their valuations swell close to trillion dollars, bigger than many individual economies. These companies have built offerings serving billions of users which generate petabytes of valuable data, unlocking infinite monetization potential.

Advertising – The Ultimate Business Model

- User data is the key to understanding and retaining users, improving and cross-selling offerings, and serving targeted ads. Alphabet (Google), Facebook, Tencent, Microsoft, Amazon and Apple all see great value in advertising as a top-line and bottom-line driver.

- The fight for eyeballs or clicks is fiercer than ever.

- While Apple has cornered the world’s most lucrative premium user base using its expensive devices and services, Facebook and Google have been entrenching themselves in the rest of the market.

- Microsoft and Amazon are monetizing data indirectly via cloud, training AI engines and obviously servicing ads within their platforms (like Bing/Windows and Amazon Marketplace). Alibaba (commerce), Tencent (communication) and Baidu (search) have full control over the billion-user China market.

- Upcoming players such as Uber, Xiaomi and Jio Platforms also aim to leverage user data of hundreds of millions of users to boost top-line by cross-selling or serving ads.

It has become a game of monetizing the massive user bases with the data directly or indirectly. Out of all the approaches, advertising as a business model rules and has the utmost potential for monetization, even more than content or hardware. This is evident from the growing combined market cap of advertising-driven tech companies. This is also the space where interesting dynamics are at work between the entities controlling access to these billions of users, and will shape the competitive landscape going forward.

Advertising Walled Gardens Cropping Up

- More than 3.5 billion users globally own smartphones out of which close to a billion use iOS-powered Apple iPhones and the rest Android (Google or forks).

- Until now, most of the big tech giants such as Facebook, Google and Amazon were able to get some level of probes into the Apple users and generate advertising revenues.

- However, Apple over a couple of years has been building a strong “privacy-centric” narrative in a bid to protect the user data from these third-party ad platforms or applications such as Facebook.

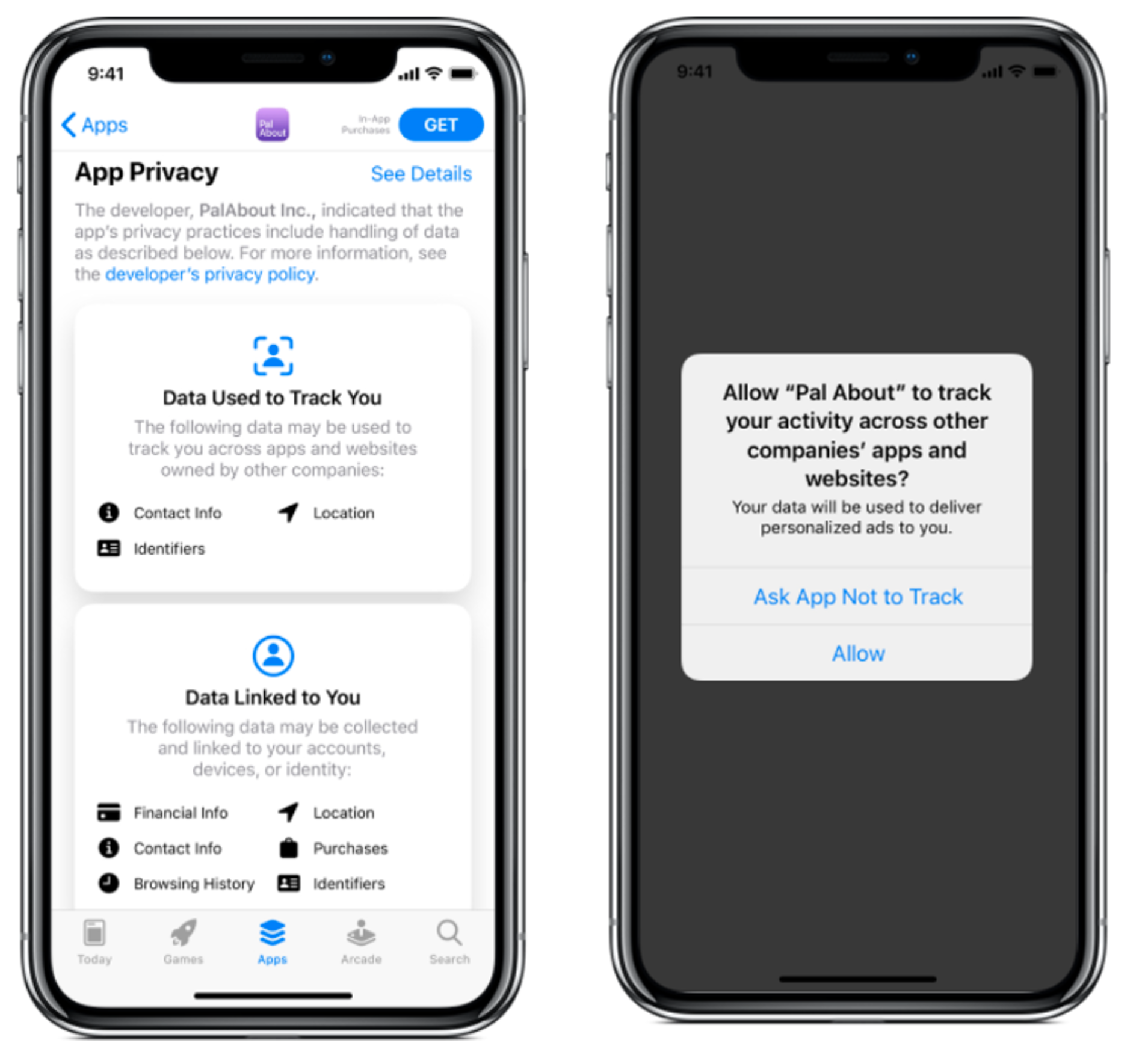

- As a first step, Apple killed Identifier for Advertisers (IDFA) last year with its iOS14, crippling the advertisers in tracking of users.

- In its next move, Apple rolled out the App Tracking Transparency (ATT) privacy policy with the recent iOS 14.5 update, limiting third-party mobile ad platforms’ ability to track and collect the user data by demanding an opt-in from the user to allow tracking.

- This is a big blow to the likes of Facebook as the company loses its access to the most lucrative user base in the world, making it less attractive for the marketers.

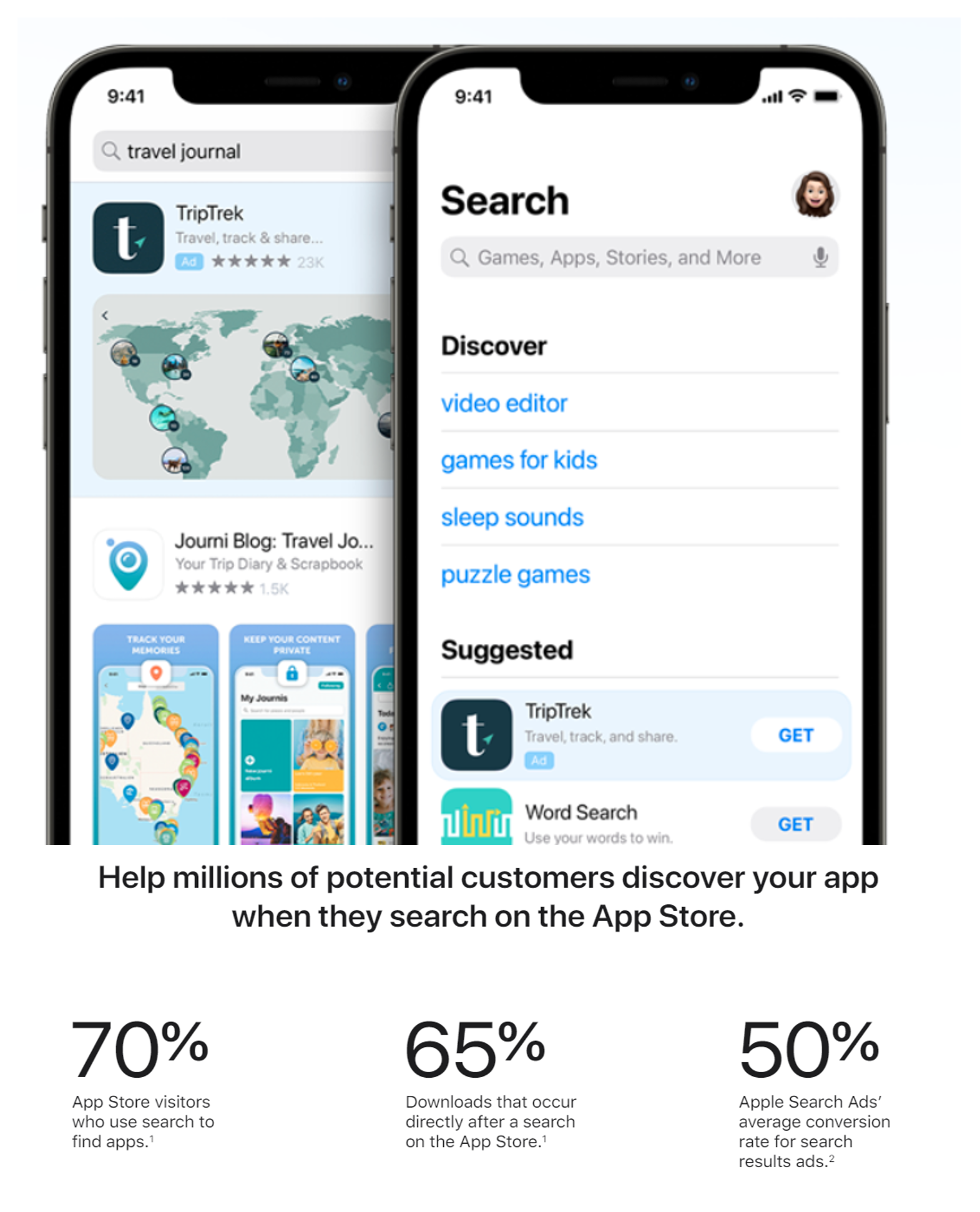

- Even as Apple looks to cut off access to third-party ad platforms in the name of privacy, it is ramping up its own advertising platform to take full control over its user base and the potential monetization opportunity.

This is a clever move by Apple to expand its monetization opportunity which is significant. Apple is not leaving money on the table.

This is a clever move by Apple to expand its monetization opportunity which is significant. Apple is not leaving money on the table.- While the third-party ad platforms might see this power move unfair and anti-competitive, Apple has leverage here along with a very compelling privacy narrative to convince its user base and the industry that it is “more trustworthy and less evil option” compared to Facebook, Google or other ad platforms.

- So, the next ads you see on the iOS platform will be pushed by Apple, targeting you astutely with tons of data it collects from every tap or click or purchase on the iOS devices.

- We estimate marketers will pay top dollar for access to Apple’s premium user base.

This will further boost its overall ad revenues. Apple already has growing revenues from its App store and browser search.

This will further boost its overall ad revenues. Apple already has growing revenues from its App store and browser search.

Apple is staring at a potential $60 billion per year minimum from advertising opportunity.

- This can even surpass App Store revenues in next few years, in addition to the other growing revenue opportunities Apple can capitalize on.

- It would be a bold move if Apple offers a more transparent “opt-in” to its users for its own advertising platform as well to remain fair and true to its privacy stance.

This can set a very strong precedent for other ecosystems to adopt a similar “privacy or security”-led framework to kick out the third-party platforms and become more closed sooner rather than later.

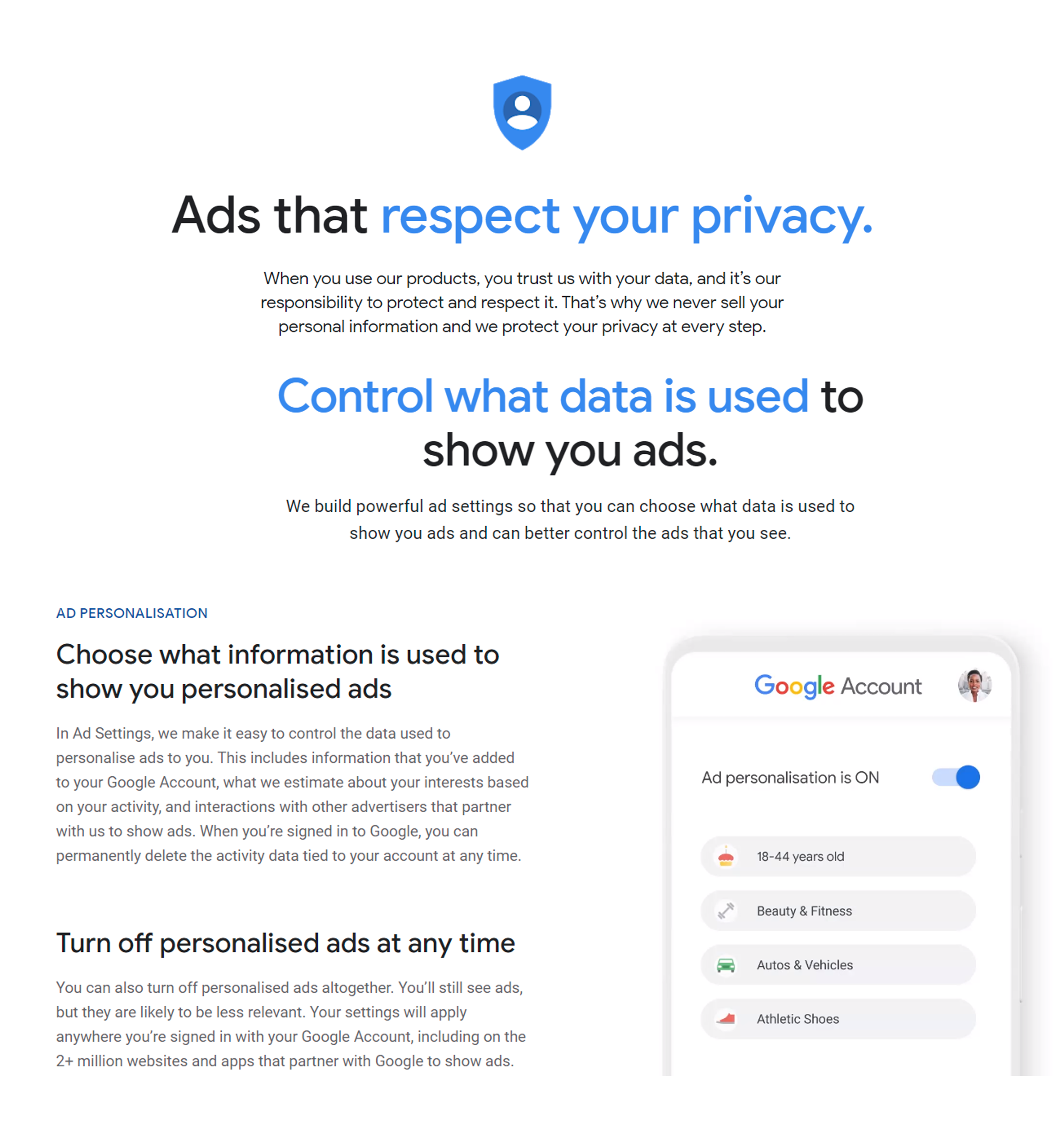

- Google still controls the lion’s share of ad revenues via its platform and also has a side-deal with Apple, paying the Cupertino giant billions of dollars in return for search ad revenues from the Apple platform.

- If Google takes a leaf out of Apple’s playbook here, it would be more than happy to keep all the ad revenues generated from Android for itself.

- Google has already been tightening up privacy and ad personalization, and moving towards taking more control of the advertising on its platform.

- This could be a death knell for the likes of Facebook and other platforms, kick-starting a duopoly.

It will be interesting to see how fast the Huawei ecosystem built around Harmony OS, Huawei Mobile Services (HMS) and 1+8+N strategy can grow and, if at all, provide some opportunity for other third-party ad platforms, or keep for itself like Apple.

It will be interesting to see how fast the Huawei ecosystem built around Harmony OS, Huawei Mobile Services (HMS) and 1+8+N strategy can grow and, if at all, provide some opportunity for other third-party ad platforms, or keep for itself like Apple.- This trend, if it holds, could extend to other market segments where advertising could really thrive, like XR, PCs or autonomous vehicles

- Fortunately for Facebook, it has cornered almost half of the XR landscape with its Oculus portfolio. But with Apple’s entry, the dynamics could shift swiftly.

In summary, we are at a pivotal stage where we could see significant power shifts. The Advertising Walled Gardens are about to bloom.

This is a clever move by Apple to expand its monetization opportunity which is significant. Apple is not leaving money on the table.

This is a clever move by Apple to expand its monetization opportunity which is significant. Apple is not leaving money on the table. This will further boost its overall ad revenues. Apple already has growing revenues from its App store and browser search.

This will further boost its overall ad revenues. Apple already has growing revenues from its App store and browser search. It will be interesting to see how fast the Huawei ecosystem built around

It will be interesting to see how fast the Huawei ecosystem built around