- Compared to its 4G rollout, India 5G rollout has been much quicker and smoother.

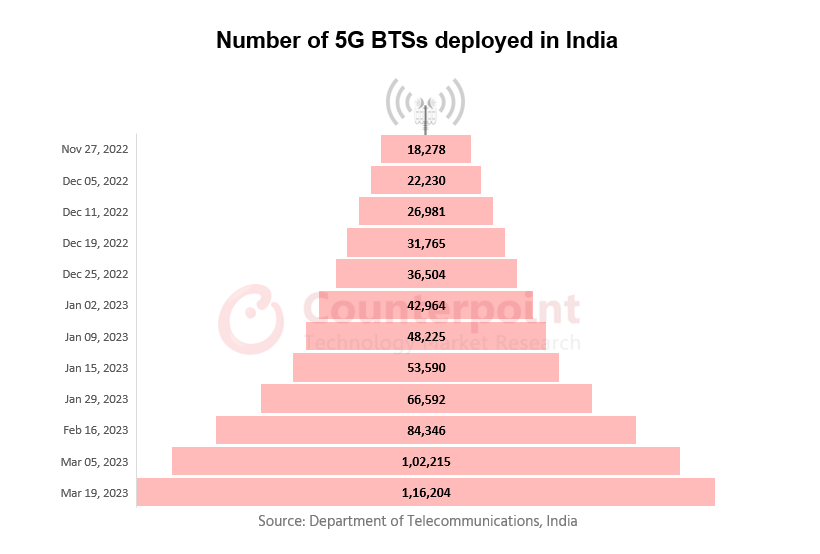

- By March 2023, 116,204 5G BTSs had been deployed throughout the country.

- India’s 5G smartphone shipments are expected to exceed that of 4G smartphones this year.

- Vi and BSNL are expected to join Jio and Airtel in rolling out 5G by 2024.

India’s digital transformation journey has been spectacular. While its initial phases were marred by delayed deployments of the latest mobile telephony (there was a gap of around six years between the auction and mass deployment of 4G waves!), and regulatory and other roadblocks, the ecosystem managed to get its act together and 5G has seen comparatively much quicker and smoother rollout. Government initiatives like Digital India have also helped in the transformation. All this has led to an exponential increase in demand for data in India. Accelerated by low tariffs and easy availability of low-cost 4G smartphones, India’s mobile-first broadband has witnessed tremendous growth and continues to do so in the early stages of the 5G era.

Present–day 5G

Launched on October 1, 2022, in India after much deliberation on pricing and policy, and pandemic-driven delays, the 5G spectrum has not only seen quicker rollout and adoption than those of previous technologies in the country but also quicker than in other emerging markets. The Indian government’s initial recommendation was to deploy at least 10,000 5G BTSs (base transceiver stations) per week. After a slow start, telcos picked up significant pace in the new year. In December 2022, the cumulative number of 5G BTSs that had been deployed was approximately 22,000, with the weekly average being 2,500 5G BTSs. But by March 2023, Jio and Airtel together had successfully deployed 116,204 5G BTSs throughout the country.

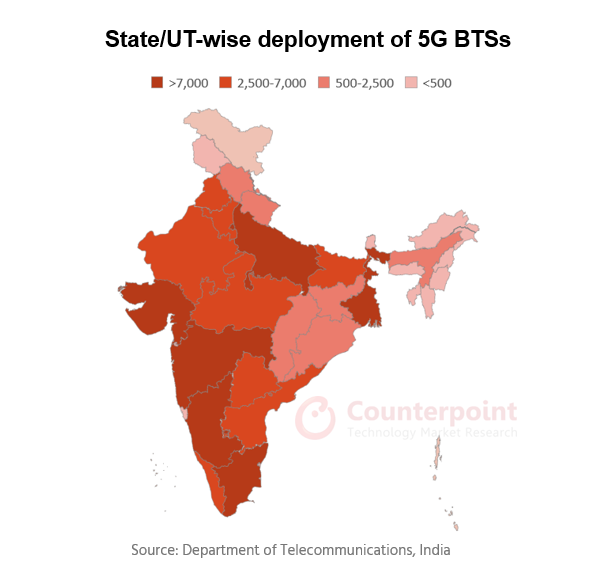

Out of the total 35 states and union territories, 6 states and union territories – Maharashtra, Uttar Pradesh, Tamil Nadu, Gujarat, Karnataka and Delhi – have more than 50% of the 5G BTSs deployed so far. Further, Jio is operating in the SA (Standalone) mode, i.e. 5G NR (New Radio) linked to 5G Core, unlike Airtel which had to opt for the NSA (Non-Standalone) mode, with 5G RAN (Radio Access Network) still connected to the legacy 4G EPC (Evolved Packet Core). Jio’s 5G services are available in nearly 406 cities, while Airtel covers around 500 cities with its ‘5G Plus’ services.

Operator strategies

- Jio’s acquisition of the 700MHz spectrum will help the operator deploy 5G with greater coverage. The deployment of 5G services on both 700MHz and 3500MHz spectrums has elevated the performance of mobile networks.

- Jio also claims that at least 90% of its deployed 5G BTSs are fiberized.

- Airtel’s deployment of 5G in the NSA mode means it can deploy 5G BTSs alongside 4G equipment, hence reducing the time required to set up the network.

- Airtel has already crossed the 10–million unique 5G subscribers mark. As subscribers continue to purchase 5G smartphones and telcos continue to provide 5G services at low to no premium, the number of users migrating to 5G will motivate operators to expand coverage at a rapid pace.

- Despite Jio and Airtel having different strategies for 5G deployment, both will be looking forward to bridging the digital divide through 5G FWA and helping industries digitally transform through 5G private networks.

- Jio has introduced its 5G FWA services in regions with high footfalls. As networks get denser and more infrastructure is erected, FWA will play the most important role in taking high-performing mobile broadband to places unserved by fixed wireline.

- Airtel has started making inroads into the enterprise segment, successfully deploying its 5G services with Mahindra & Mahindra, Apollo Hospitals and Bosch.

- Owing to adequate spectrum with operators and 5G’s inherently higher capacity, the cost of generating 5G data is much lower than that for 4G, a relief for operators struggling with ARPU (average revenue per user).

- This forms a fundamental part of Indian operators’ future course of action where they prioritize attempts to “go green” and make their architecture more energy efficient as they look to optimize “Tower, Power and Fiber”.

Current ecosystem

- The development of the 5G ecosystem and its early acceptance has incentivized the operators to deploy more 5G infrastructure and claim an early lead on the subscriber base.

- 5G became one of the most sought-after smartphone features in 2022. 5G smartphones captured a 32% market share in 2022. Counterpoint Research estimates that currently there are nearly 85 million users of 5G capable handsets in India.

- The growth of 5G smartphones in India can be attributed to the availability of affordable handsets. Priced at $121 (~INR 10,000), Lava’s Blaze 5G is one of the most economical 5G handsets in the market.

- Counterpoint expects 5G smartphone shipments to exceed 4G smartphone shipments by the end of 2023. As the market grows, we might also see 5G smartphones in the sub-INR 10,000 price band.

- Technology-centric reforms have been another factor that has eased 5G deployment in the country. The regulatory process and fees related to Right of Way permissions have also been rationalized to bring uniformity across the country, which is a major factor in setting up the backhaul network.

Challenges

- Despite the growth of the 5G ecosystem, 5G smartphones still do not form a substantial part of the total smartphone installed base in India.

- There also remains a question of commercial viability as telecom is one of the most heavily taxed sectors and low tariffs add more fuel to the fire.

- Indian telcos’ ARPU is very low (approximately $2) compared to the global average (approximately $7).

- Any 5G tariff hike is dependent on the number of 5G subscribers. As telcos go deeper into the country’s rural areas, the 5G sentiment changes, creating more complexities with respect to pricing and eventual investments.

- The operators are also struggling with developing more 5G use cases except for eMBB and FWA, which are considered the most convenient, but not killer, use cases.

- The ecosystem demands contributions from various sectors, especially from start-ups that can be a provider of new-age solutions to propel holistic multi-dimensional growth.

- MNOs will require more support from equipment manufacturers to help deploy affordable services. Both the operators are looking forward to complementing their FWA services with affordable high-performing 5G CPEs.

Future of 5G in India

- Industry leaders worldwide look forward to 5G growth in India. In the recently held 5G Congress in New Delhi, operators and vendors were very enthusiastic about the 5G rollout and claimed that there won’t be any slowing down.

- Key players such as Ericsson are very optimistic about the development of 5G in India and believe that soon India will be able to adopt 5G use cases for deployment and not long before would start contributing as well.

- Equipment manufacturers believe that India will follow the global trends of demand increase and deployment of private networks. Networking giants, operators and system integrators have been increasingly investing in developing private 5G businesses in India.

- India’s telecom sector has also witnessed several strategic moves, including tie-ups by key ecosystem players, for private 5G solutions and helping various sectors such as manufacturing, agriculture, mining and education to digitally transform themselves.

- On the government side, alongside several reforms in existing policies, the PM GatiShakti National Master Plan has been introduced for a quick 5G rollout and to help increase fiberization in the country.

- Progressive mapping of street furniture, which will be an important part of 5G infrastructure, is being carried out. Tools such as Shortest Distance, 5G planning and RoW (right of way) will provide the telecom service providers with detailed information to enable quick deployment of 5G BTSs and optical fiber.

- In the 2023 annual budget, the government also proposed setting up 100 labs to develop 5G use cases across the country. Regulatory officials have also studied other countries’ 5G action plans and frameworks to adopt best practices.

- At the 5G Congress, Minister of State for Communications Devusinh Chauhan said that there would be further improvement in existing policies. This comes after Prime Minister Narendra Modi unveiled the Bharat 6G Vision Document and launched India’s first 6G test bed, just six months after the commercial launch of 5G.

- 5G will play a key role in achieving India’s digital goals. While the current share of 5G BTSs in total BTSs is very small, it will gradually increase as the other two operators – Vi and BSNL – launch their 5G services by 2024.