Nordic vendors Ericsson and Nokia had a good second quarter. Ericsson reported a 13.7%* growth in revenue to $6 billion with net profit jumping 19.2 % to $451 million. Nokia’s revenue was almost identical at $6.1 billion, up 10.5%, while profits surged 31.1% to $478 million. Both benefited from favourable currency conditions, particularly in the US, their biggest market. The two vendors remain bullish for the rest of 2022 and into 2023.

Regional Trends

Ericsson reported growth across all its regions with the top markets in terms of revenue being North America, up 27.3%, Europe and Latin America, up 9.4% and South East Asia, Oceania and India, up 12.2%. The Middle East and Africa region also reported a strong 17.1% growth. Nokia reported growth across several regions (excluding Europe and India), with its strongest markets being North America, up 34.6%, Middle East and Africa, up 22.8% and Greater China, up 13.9%.

North America continues to be the preeminent market in revenue terms for both vendors. And as has been the case for several quarters, Nokia’s strong growth in the US was driven by a double-digit growth in Network Infrastructure and helped this quarter by a return to growth at its Mobile Networks business.

Network Infrastructure continues to be a star performer for Nokia with a 21% growth overall, led by Fixed Networks up 34% and Submarine Networks, up 27%. Nokia reports that increasing 5G and fibre access penetration is leading to increasing demand for backhaul solutions, which is driving sales of its IP routing and metro/backbone optical network solutions. Although Nokia expects its double-digit growth to continue in the short-term, maintaining this growth rate will inevitably become more difficult over time.

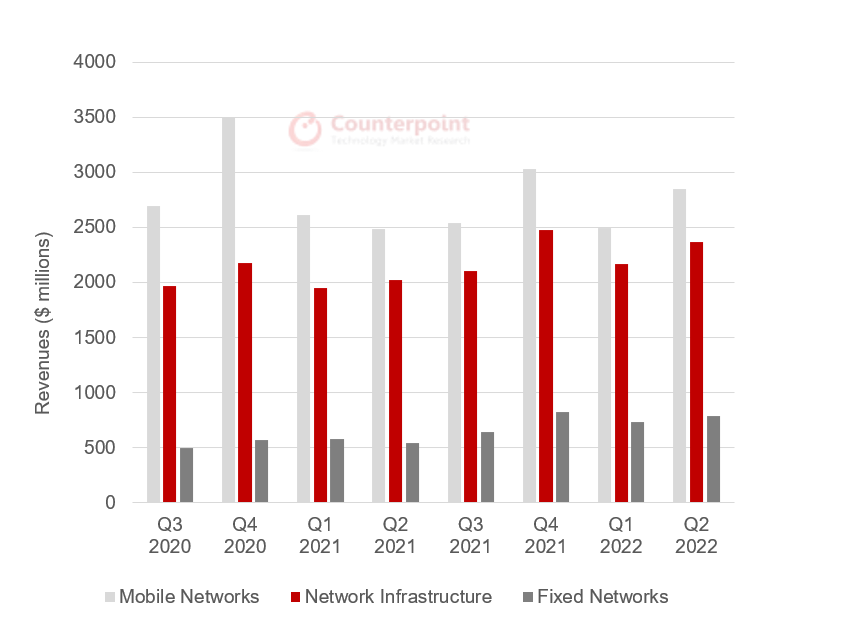

Nevertheless, Counterpoint Research expects that Nokia’s Network Infrastructure revenues will surpass Mobile Networks before the end of 2023, driven predominantly by continued growth in Fixed Networks. In fact, Fixed Networks revenue equalled IP Routing revenues for the first time at the end of Q2, and together the two businesses now account for 67% of total Network Infrastructure revenues. Exhibit 1 compares the growth of Nokia’s Mobile Networks compared to Network Infrastructure during the past two years.

Exhibit 1: Nokia: Mobile Networks versus Network Infrastructure Growth

Supply Chain Issues

Both vendors are carefully managing their supply chains but with perhaps a slightly different focus, with Ericsson seemingly more concerned on maintaining top-line growth. Overall, Ericsson claimed that supply chain issues have not had any impact on revenues up to now, with products delivered in quantity and on-time due to good supply chain management. However, increased inventory costs are clearly having an impact on its bottom line, denting its gross margin and reducing cash flow metrics.

In contrast, Nokia seems more focused on managing the bottom line and keeping costs under control. Throughout 2021, it faced challenging supply chain constrains with many of its suppliers. However, the vendor recently reported that these constraints are now more supplier specific, with a shortage of optical components being a particular concern. Faced with volatile lead times, Nokia increased inventory by $240 million in Q2 and will maintain this level of inventory until lead times become less volatile. Both vendors expect that supply chain challenges will start to ease in late 2022 and early 2023.

5G Outlook and Headwinds

Like most 5G vendors, the two Nordic vendors believe that the 5G capex peak will be higher and last longer than previous generations although there might be some normalization in 2024. Nokia continues to see strong investment in 5G connectivity and fibre deployments, two priorities for CSPs and their enterprise customers, as they deal with increasing data consumption and the need to improve productivity. To date, Nokia claims that it has not seen any major changes in customer demand and order intake remains strong with the company being more supply limited than demand limited. Ericsson also expects continued solid demand throughout 2022 and has increased its forecast revenues for North America.

However, a deteriorating macro environment could dampen customer demand over the next few months, particularly in emerging market countries, where currency fluctuations could impact the affordability of 5G products typically priced in dollars or euros. In addition, vendors are experiencing other headwinds such as inflation, higher R&D costs, etc. However, Counterpoint Research believes that both companies have a limited degree of pricing power, and by increasing prices and the cadence of new products, they should be able to offset some of the inflationary pressures, For example, offering new products that reduce opex costs – such as smaller, lighter, lower-power radios – would enable CSPs to justify additional investments.

Low 5G and Fibre Penetration

Counterpoint Research expects that the 5G market’s secular growth pattern will continue, as even in a worsening macro environment, CSPs need to invest in networks to increase bandwidth and improve productivity. The demand for enterprise digitization is also unlikely to wane in the short term. Outside China, the penetration of 5G and fibre remains low. For example, in North America, the penetration of mid-band 5G is less than 25% while in Europe it is under 15%. With such low penetrations, CSPs are extending 4G network coverage, densifying networks while at the same time transitioning to 5G. Unlike for many other industries, therefore, the impact of the impending recession could well be minimal for 5G infrastructure vendors.

* All revenue data is YoY, i.e. compared to Q2 2021 and is reported rather then adjusted constant currency revenue.