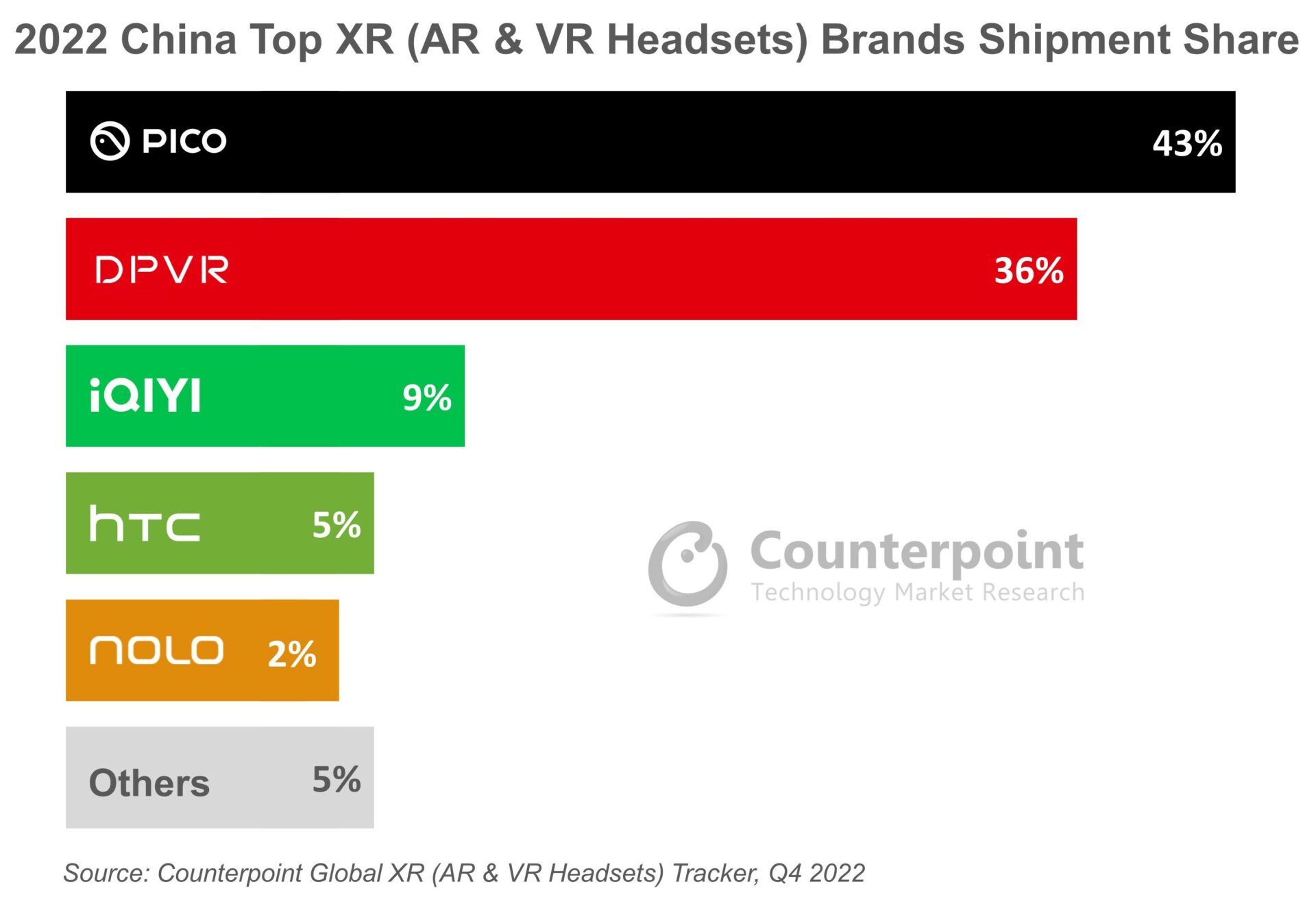

- XR shipments crossed 1.1 million units in China in 2022.

- VR remains the dominant segment, contributing more than 95% to overall shipments in 2022.

- Pico is the number one brand with a shipment share of 43%, followed by DPVR at 36%.

- iQIYI, HTC and NOLO, each captured a single-digit share.

London, San Diego, New Delhi, Beijing, Buenos Aires, Seoul, Hong Kong – March 15, 2023

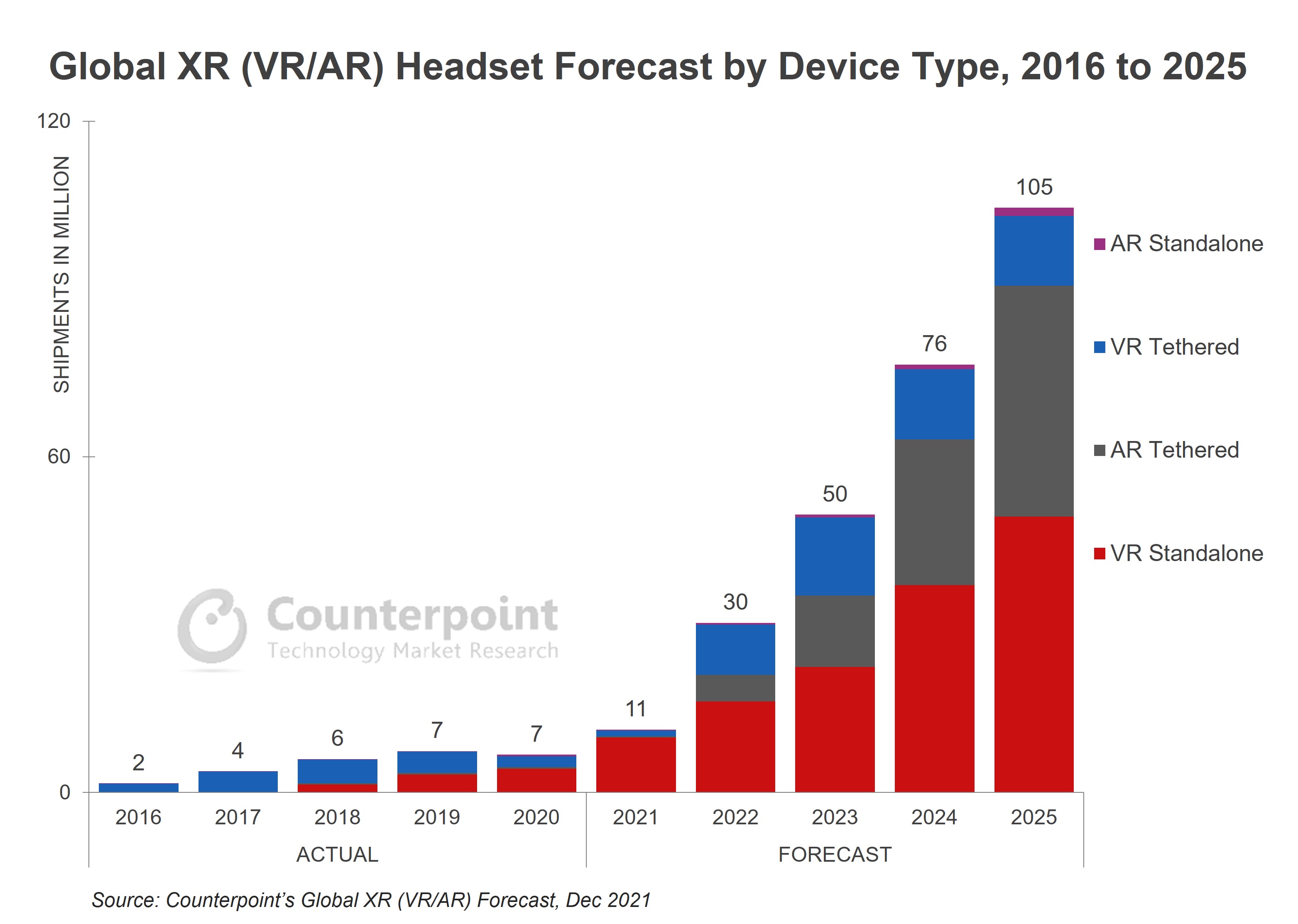

Extended Reality [XR: Augmented Reality (AR) and Virtual Reality (VR) headsets] shipments crossed 1.1 million units in China in 2022 according to Counterpoint Research’s XR Model Tracker. VR remains the dominant segment within XR, contributing more than 95% to overall shipments in 2022. The Chinese market has considerable untapped potential but is growing slowly because available headsets do not offer enough value in the consumer domain for mass consumption.

While the consumer segment did not see a major shift, volume growth was produced by enterprise deals, mostly in the education and training sectors. The potential for further volume growth is limited in the enterprise segment which remains niche as the currently available headsets are not yet advanced enough to offer enticing use cases. So, brands have started to focus more on the consumer segment, particularly gaming. However, Chinese brands are offering few and mostly simple VR games. Brands must develop high-quality games to increase consumer traction.

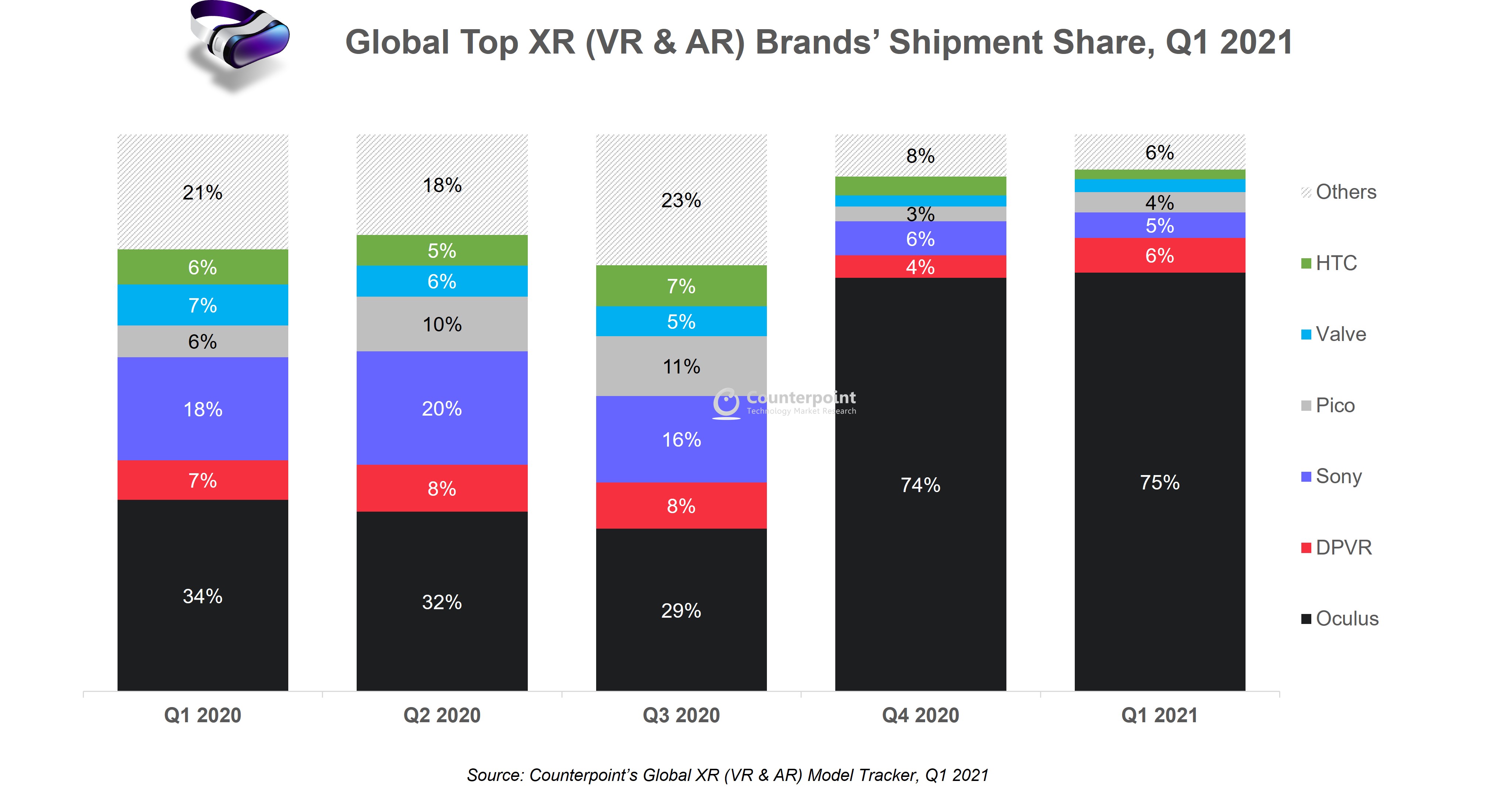

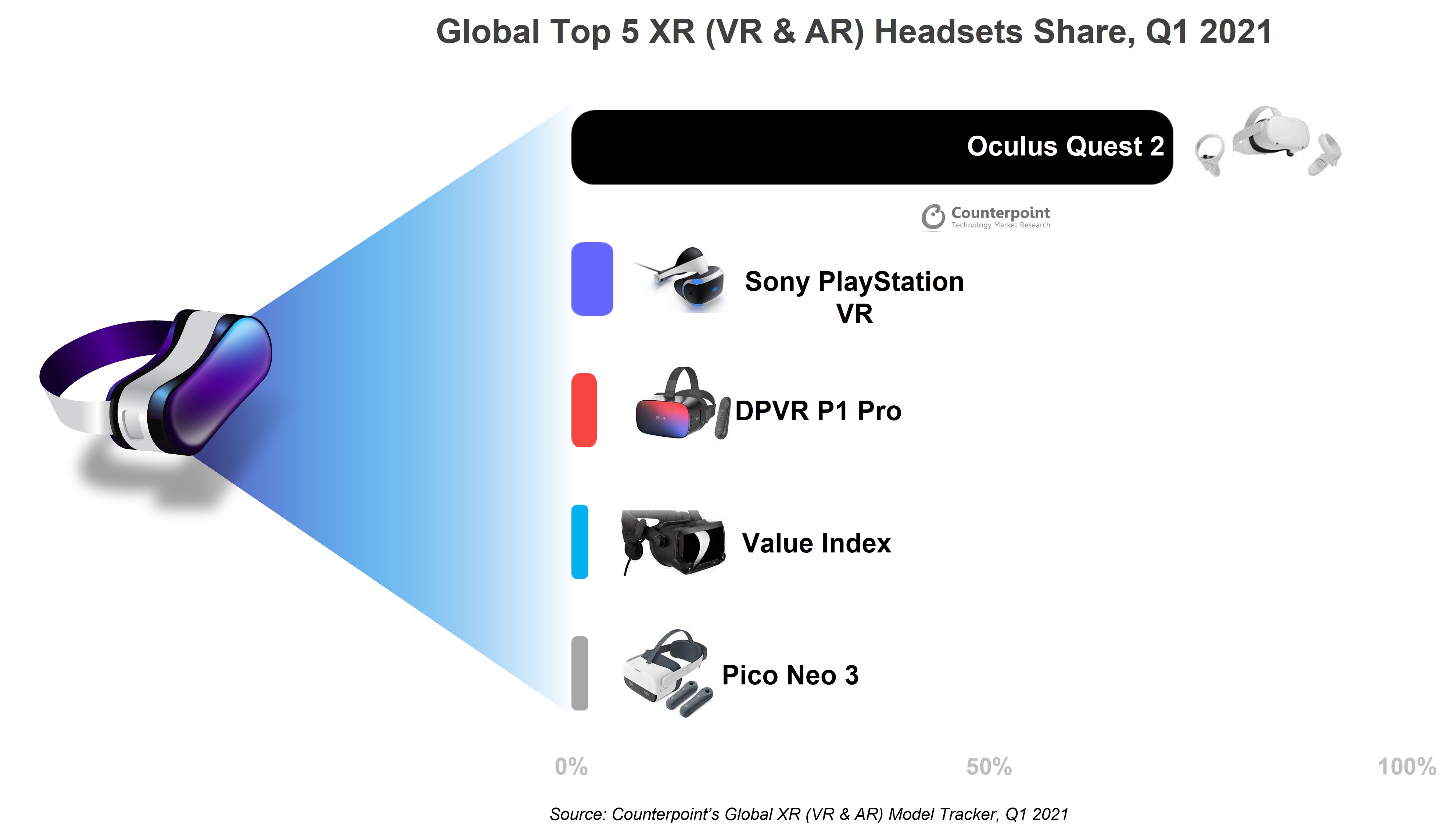

Pico is the number one brand in China’s XR market with a shipment share of 43% in 2022, followed by DPVR at 36%. iQIYI, HTC and NOLO, each of which captured a single-digit share, also made it to the top five.

Pico, since its acquisition by TikTok’s parent, ByteDance, has gained greater global as well as local prominence. The additional financial, human and soft resources that ByteDance is pouring into Pico helped it to become a major player. Since the acquisition, Pico’s strategy has been to establish itself as a major player in the consumer XR segment. For this, it has priced its recent Pico 4 headset at close to $400, similar to Meta’s Quest 2.

DPVR shipped the next highest number of XR headsets in China and is the biggest player in the enterprise segment. Existing partnerships and growing regional prominence will ensure a healthy growth rate for DPVR, but it has a limited opportunity for volume growth in the enterprise segment. It is therefore betting big on its E4 gaming headset.

iQIYI, with a focus on VR content and streaming, took the third spot on the list while HTC’s volumes continued to be driven by Vive Flow. However, HTC is facing difficulty to sell its headsets owing to their high price points. NOLO also made it to the top five list thanks to its consumer-grade headsets targeted at gamers.

China’s market has a large base of home-grown content producers who benefit from a largely common language. We expect these players to increasingly invest in content for VR leading to a virtuous circle of increasingly capable hardware supported by content from multiple producers. The adoption of XR in sectors ranging from education and healthcare to industrial and supply chains will also enable more holistic growth represented by both the consumer and enterprise segments.

China is also expected to benefit from the early adoption of 5G since telecom operators see VR content as a driver of data consumption.

Background:

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts:

Follow Counterpoint Research

press(at)counterpointresearch.com

![]()