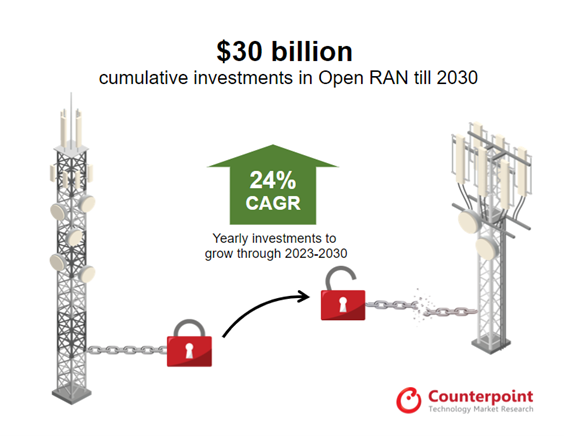

- Accelerated growth is expected from 2025 onwards after stagnation in 2023 and 2024.

- Open RAN network investments to grow at a CAGR of 24% during the forecast period.

- Asia-Pacific and North America will remain the largest Open RAN markets in the forecast period.

- Europe is expected to record the fastest growth with a CAGR of 108% during 2023-2030.

Open RAN network investments have increased steadily in recent years, driven primarily by greenfield network operators in the Asia-Pacific and North American regions. However, following this period of rapid network build-outs, greenfield operators are looking to lower capex in 2023 and 2024 and focus on network monetization. Some Tier-1 operators, notably Vodafone, have announced major plans recently to deploy open RAN, but most brownfield network operators remain very cautious about additional investments in 5G infrastructure, particularly Open RAN, due to the uncertain macroeconomic climate.

As a result, Counterpoint Research expects that the Open RAN market will stagnate during this and the next year. Investments will start to increase YoY after 2025 with network operators investing a cumulative total of more than $30 billion between 2022 and 2030. This represents a CAGR of 24% for the forecast period of 2023-2030.

Although the Asia-Pacific and North American regions will remain the largest Open RAN markets for most of the forecast period, Europe is expected to record the fastest growth with a CAGR of 108% between 2023 and 2030 as its Tier-1s finally start commercial deployments at scale, driven partly by the need to replace legacy Chinese 3G and 4G networks.

The Open RAN-compliant radio market to date has been dominated by Asian vendors Samsung, NEC and Fujitsu. However, Counterpoint Research expects that their market share will be impacted during the forecast period as other incumbents start offering Open RAN-compliant solutions.

Counterpoint Research’s recently published Open RAN Tracker is the culmination of an extensive study on the Open RAN market. The tracker provides details of all operators across different regions, covering both trial and commercially deployed networks, and market shares by region and by vendor.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.