Samsung management could be forgiven for wondering what they’re doing wrong. The Galaxy S6 was expected to project Samsung back on to a positive trajectory after a difficult year, but the latest sales data suggest it is misfiring.

The Galaxy S5 was heavily criticized for being, well, a bit boring. It sold OK but not quite as well as its predecessor the Galaxy S4, which now looks like it was the apogee of Android smartphone sales.

Determined not to make the same mistake with the Galaxy S6, Samsung stepped-up its efforts on the industrial design. This product — especially the Edge version — looked good. Even veteran analysts who have seen just about every handset launch since the beginning of time, well the cellular phone era at least, felt the stirrings of interest. Add to this the news that operators in key markets were more excited by the S6 than the S5 and the signs looked positive. It was easy to conclude that sales would be good for the S6 product range.

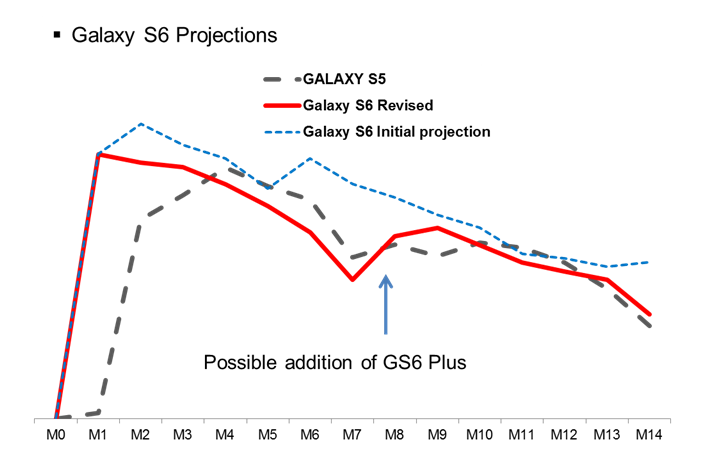

Counterpoint’s early estimates suggested a volume of 50m units in 2015 was possible. We now are lowering the forecasts to 46m which is similar to the GS4. This includes all spin-off models if launched this year, like the rumored GS6 Pulse as it will cannibalize original GS6 sales.

The Edge version was, by far, the more desirable of the two products in the Galaxy S6 family. The double curved edge display presented manufacturing challenges. It was evident from early on that production volumes would initially be limited.

Unfortunately it looks like the production issues that held up the Edge model and the overall high pricing of both S6 models has hurt sales in the first 3 months. Given the rapidity of the Galaxy S sales cycle, it’s now very difficult for Samsung to catch back those unit sales lost even with production issues resolved. Our retail checks our showing that the consumer interest is drifting away from the GS6 Edge even though stock has been replenished. The biggest reason is the high price tag.

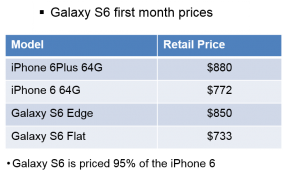

The initial S6 pricing was on the level of the iPhone 6 and the S6 Edge with the iPhone 6 Plus. Given that Samsung doesn’t have either the brand kudos of Apple or the ecosystem strength, this level of pricing may have been considered ambitious.

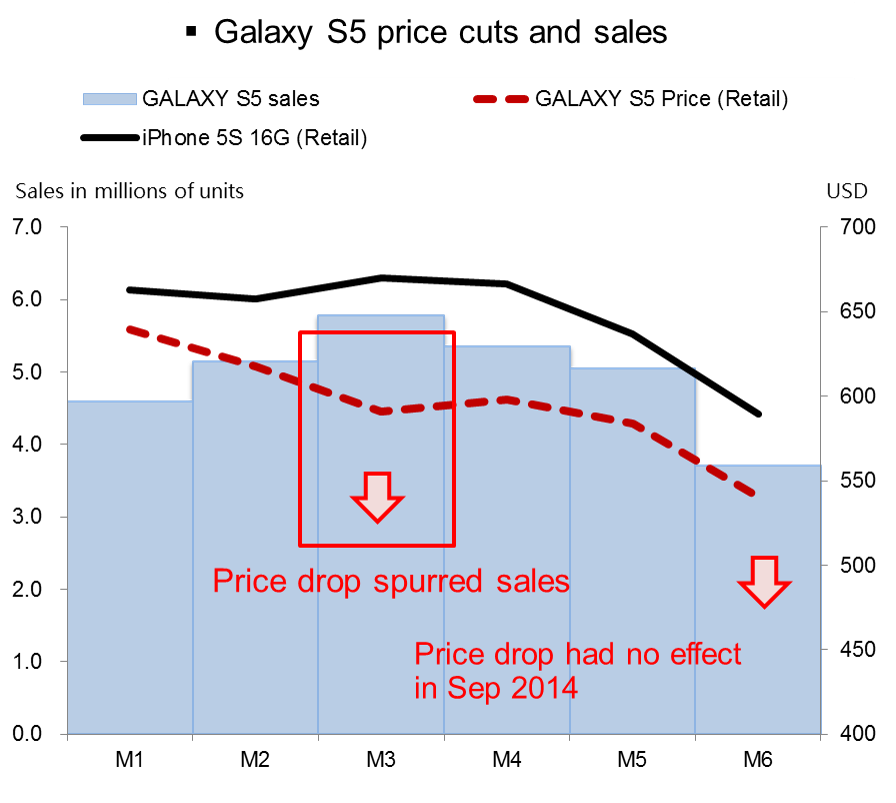

If we look back at the Galaxy S5 it too was priced similarly to the iPhone (5S) after launch. Samsung however lowered the price of the Galaxy S5 in month three of the product’s sales. This price movement catalysed a positive up-tick in volume sales. However a further price drop in month six did not reignite sales growth — though it may have halted what would otherwise have been a faster downward slide.

We therefore expect that Samsung will have to lower the price of the Galaxy S6 and S6 Edge. This means it will have to compensate distribution channel partners holding unsold stock, chiefly of the standard GS6. If Samsung undertakes this pricing move will it give a boost to the GS6? We think it might, but it’s unlikely to push it back to the trajectory we had originally expected.

The market is somewhat different than it was a year ago — the iPhone 6 is far more competitive than the 5S was. The second tier competitors are also stronger than they were a year ago. So it’s not conclusive that Samsung would gain volume by moving pricing now to offset the loss in profit that would result. However not to move price will likely lead to a relatively sharp further fall in sales volumes for the Galaxy S6 family.

More hurdles ahead

We also have to consider competitor product pricing in the broader sense. Not only is the Galaxy S6 in competition with iPhone 6, but all the other Android products in the market — of which there are hundreds. Hardware specifications do not provide a sustainable basis for differentiation. There are multiple products available with high-end specifications but at mid-range prices. Consumers are becoming savvy to this fact and are opting to buy brands that may have less global awareness than Samsung, but are perfectly credible players in their own right. These include brands like Huawei (and its online brand Honor), Xiaomi, Vivo, Oppo and many local brands. And many of their products are being built by a handful of ODMs in Shenzen that are becoming extremely capable product designers and manufacturers in their own right. The logic for choosing a Samsung over an Vivo is not as strong as it was two years ago — especially when there is a huge price delta.

Price isn’t the only concern however. Samsung is one of the best-known brands in the industry, but this doesn’t necessarily translate to best-loved. Few people have warm feelings towards the brand. And this is an important distinction. In a market where hardware and software differentiation, outside of the the Apple ecosystem, is difficult to sustain, vendors have to rely on intangible factors to achieve differentiation. Factors like innovative designs, brand warmth and unique services all contribute to the attractiveness of a product. While the S6 ticked the design box the Samsung brand was more neutral.

Another concerning issue was that Samsung had all but ceased development of its own services — relying instead on those provided as part of the GMS stack. This meant a further potential differentiator was essentially neutralized. One of the few exceptions to this was the inclusion of Samsung Pay in the Galaxy S6 thanks to Samsung’s acquisition of LoopPay. However LoopPay is unlikely to be a strong sales catalyst, at least until the reputation of the application becomes more firmly established.

Time for change in the long term strategic direction

Many investors expect that the hardware parity theory will catch-up with Apple. We point out that Apple only caught up with Android products with the launch of the iPhone 6 – and then only just. It is likely the hardware parity theory is actually having a more devastating affect on Samsung and one that it can’t fight with hardware alone or by throwing money at promoting its brand. What it needs to do is make its overall ownership proposition more attractive — and that is not something that can be done overnight – it takes a long-term strategic plan, judicious development and time.

– written by Peter Richardson, Tom Kang