Argentina’s political and economic landscape is going through huge changes. Last week Th. Mauricio Macri, the new Argentine president, took office. Macri is the former mayor of CABA, the capital city of Argentina, and belongs to a coalition between the independent party that he created, and the opposition party the traditional UCR. He is more center-right wing position, unlike the former president Kirchner’s administration that was a left-populist government. Putting the country back on track, after 12 years of very draining government will not be an easy task. Neither will it happen overnight; it will take at least a year to fully stabilize the economy.

Expected impact on mobile devices market

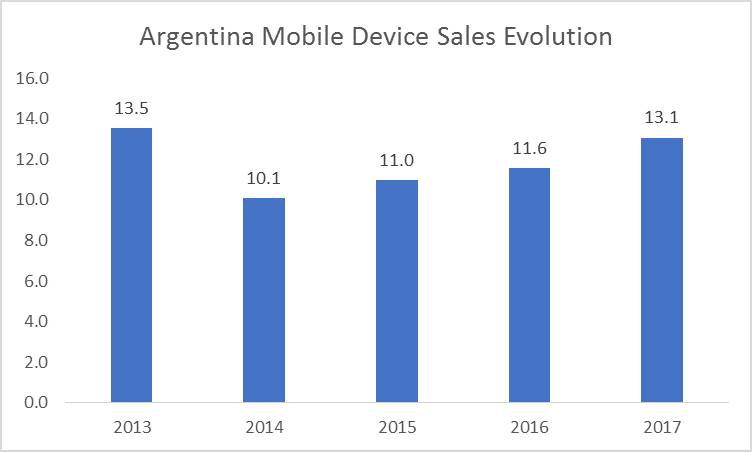

Argentina’s mobile devices market size has dropped in the last few years. We don’t see major changes in the market size between 2015 and 2016. Mainly due to expected consumer contraction during 1H 2016. This contraction is the result of currency devaluation and high inflation.

Below is the summary of some risk and opportunities for the Argentinian market for 2016.

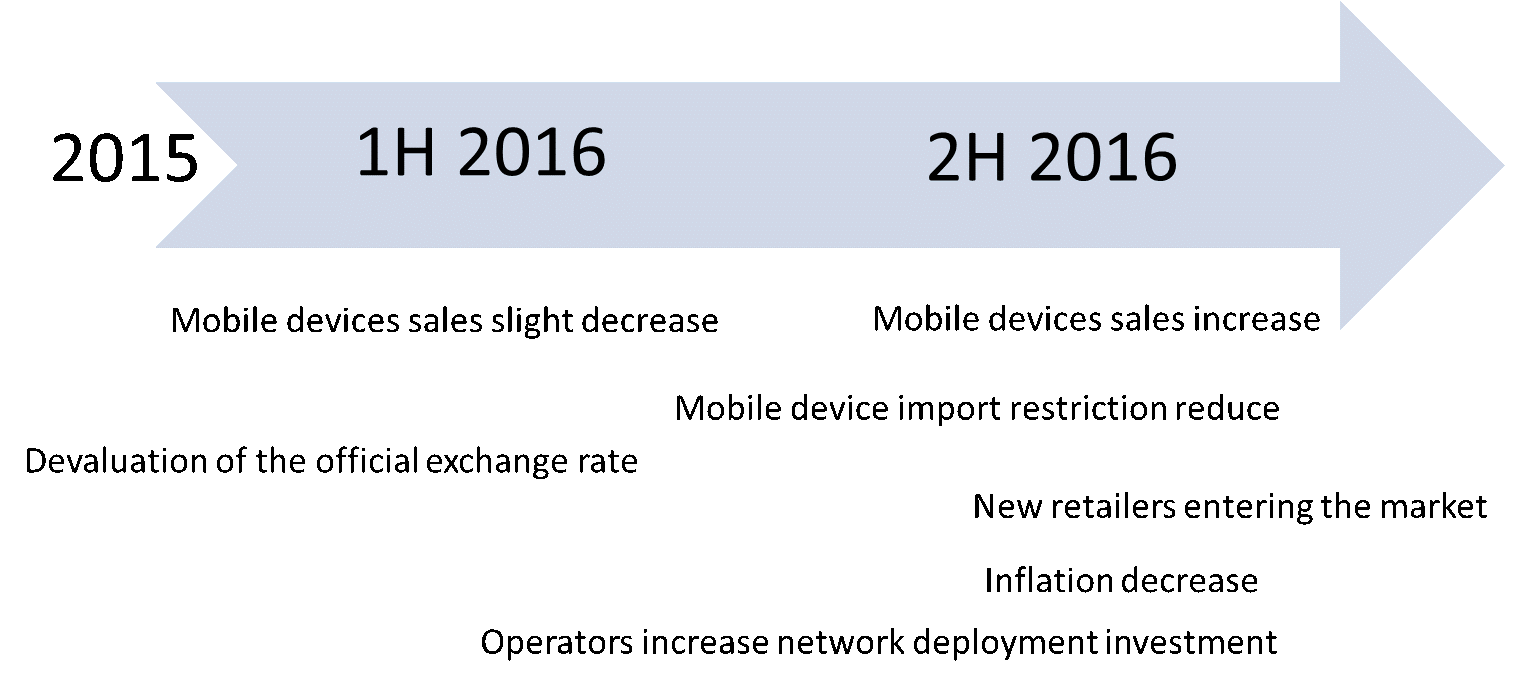

- Market size 1H 2016 sales of devices likely contract in the short term – first 3-6 months of 2016, due to currency devaluation. Inflation is expected to remain high during 1H 2016 driving handset pricing and therefore longer replacement cycles.

- Market size 2H 2016. We expect the market size to increase in the mid-term. During 2H 2016 consumer sentiment is likely positively impacted due to increasing private employment creation and inflow of foreign investment.

- Import restriction reduce. This will allow new entrants into the market – including Apple; Chinese vendors such as ZTE, Lenovo, Xiaomi, etc., and last but not least regional players such as Avvio, Lanix, Bmobile, etc. Premium and also low-end devices are likely to be the focus of initial imports as mid-range demand is somewhat fulfilled. However, lifting mobile device import restrictions will likely take time and is therefore not expected until later in 2016. This control was not legally ruled; rather just imposed by the previous administration. Therefore, the permission can technically be restored any time. However, there are local companies and workers to protect. So a measured lifting of restrictions is most likely.

- Devaluation of the official exchange rate. The exchange rate can go as high as ARS 16 to USD 1. Impacting prices hence purchasing power. Devaluation happened this week, and it is currently trading about ARS 14 to USD 1. This might increase inflation during 1H 2016 and reduce, for example, the level of overseas travel.

- New retailers entering the market, Best Buy and some online retailers are considering entering the market. This will increase competition and reduce share of current leaders, such as Garbarino and Fravega.

- Operators increase investment in new technology deployment. Currently many consumer do not care about purchasing an LTE device, as coverage is very limited. However, if LTE coverage increases, consumer will demand more LTE enabled devices.

- Inflation decrease, this not only increases consumer confidence but can also lead to lower interest rates. Lower interest rates are key to enabling installment payment options. If implemented, installment plans can drive device renewal. This is unlikely before late 2016 or early 2017. The cost of living is likely to increase during 1H 2016, as many public services will no longer be subsidized.

Argentina 2016 Risk and Opportunities Timeline

Argentina is on the path to recovery. But it might not be a smooth ride, rather a patchy one, especially during 2016. However, by the end of 2016, once major problems like inflation and devaluation are ameliorating, mobile devices and services demand will start to surge. 2016 should be the year of preparation, for the forthcoming market expansion.

by: Tina Lu