India is the world’s largest democracy, with 1.2 billion people and 3rd largest economy based on GDP (PPP basis). The country’s GDP would grow by 7.7% in 2015-16 projected by Reserve Bank of India (RBI).

India is the world’s second largest handset and the third largest smartphone market in terms of volumes globally. Indian subscriber penetration reached 77.6% in 2014, currently around 40% of the population has a mobile device.

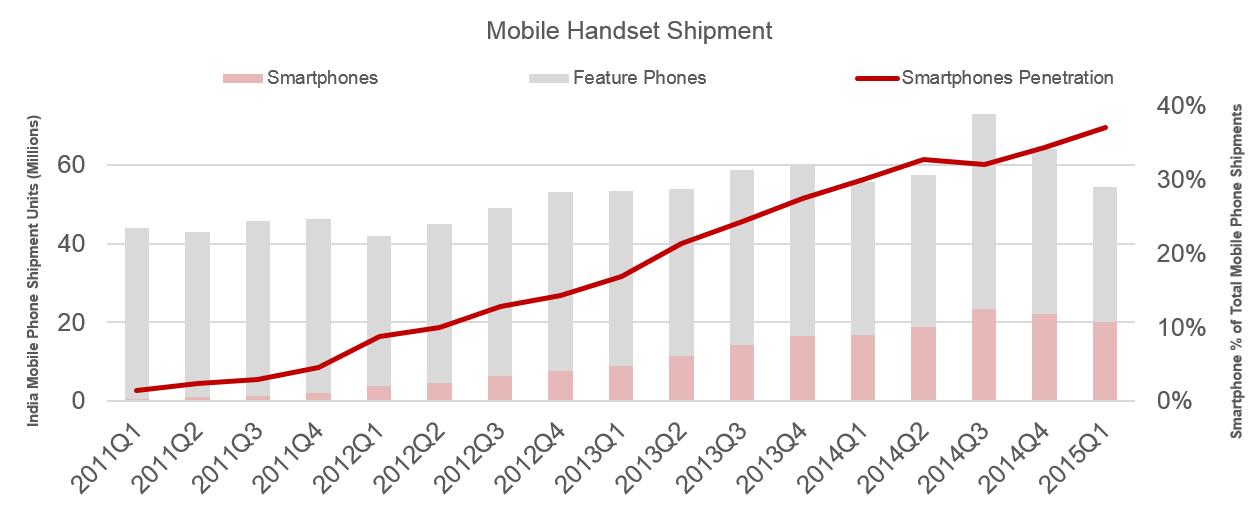

According to Counterpoint Research’s latest Market Monitor research India’s smartphone segment grew 21% YoY to end 1Q15, with penetration of smartphone increasing on a continuous basis reach 37% of total mobile shipments in 1Q15.

Overall upward demand for smartphones, changes in the government policy to set up local manufacturing and increasing input cost in country like China bigger platform for all the OEM players to set up plants in India. India is slowly converting into a major manufacturing hub for mobile handset brands. Foreign handset vendors such as Nokia, Samsung, and LG have been manufacturing mobile phones in India for many years. Now local players have started either assembling or fully manufacturing products in India.

The key drivers for this shift are:

- The growth in the Indian market – especially for smartphones. Counterpoint’s Market Monitor service estimates 250 million handsets, of which 81 million smartphones, were shipped-in to India in 2014. India as a smartphone is growing with a handsome rate.

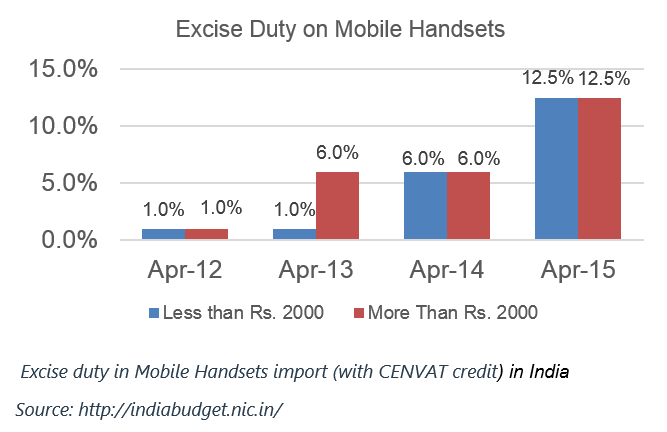

- Increased import duties for mobile handsets. Duty on imported handsets is now 12.5%. Duty on local manufacturing is only 2%. Current Indian Government is pushing the idea to make India as a manufacturing hub by promoting “Make in India” campaign, focusing on creating a business-friendly environment and benefiting local manufacturing over imports.

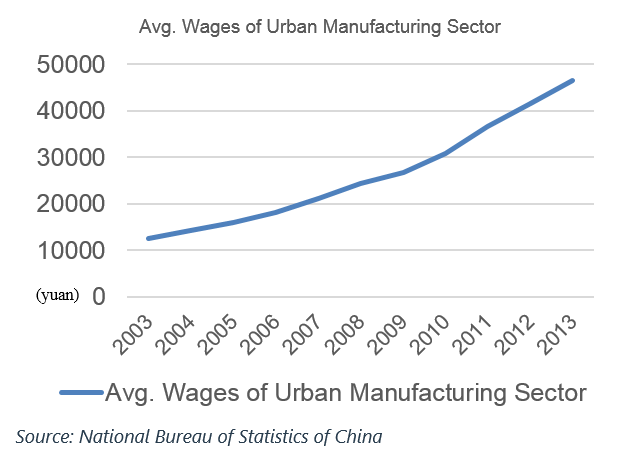

- Increased input costs of manufacturing in China. Wages in the Manufacturing sector in urban areas of China increases by 400% in last 10 years and there are hardly much difference left in input cost in china compared to developed countries.

However, this is not as easy as it seems because the competition is fierce with more than 100 domestic and international brands fighting in the same sub-$150 wholesale price-bands with international brands entering with huge scale, vertical integration, and strong brand and marketing muscle. Some smaller brands like Spice have already given up on manufacturing domestically closing down plants owing to stagnating growth and thus lack of economies of scale.

Domestic and some International vendors have either been manufacturing in India or contemplating doing so for some time. However high production costs, taxation issues and most importantly the lack of a manufacturing ecosystem has hindered this trend from becoming strongly established.

Some high-scale brands such as Nokia, Samsung and others have been successful at running viable manufacturing/assembly operations in India for years. But local brands have been less aggressive until now.

Some of the existing and proposed manufacturing are highlighted in the map.

Conclusions:

- Mobile phone manufacturing which has been centred in China is slowly moving to other Asian countries. India offers one of a number of possible locations. Indian government initiatives such as relaxed taxation, setting up Special Economic zones (SEZ) and gradual improvements to infrastructure all help.

- All stakeholders: the government, device vendors, component manufacturers, and associated software companies all have a role to play in developing India as a manufacturing hub. There are lessons on how auto manufacturers, both domestic and international, have developed India into one of the world’s biggest manufacturing/assembly hubs.

- At present only a handful of device vendors are assembling or manufacturing in India, they alone won’t be able to build a manufacturing ecosystem in India. It will be a collaborative effort and will likely take several years to be fully realized.

Above is a quick summary of report on the “India – Epicentre of Manufacturing in Future?”. To read the full report please click the link below (registration required for first-time users).

Or just drop an email to analyst(at)counterpointresearch.com and we’ll send it out to you in no time!