Price strategies and its future for 4 major operators in N. America

- With a drive to eliminate subsidy and move towards EIP (Equipment Installment Plan) models following T-Mobile’s Uncarrier footsteps, major operators will focus to shift focus from “hardware” pricing to “plans” pricing. Installments with no contracts combined with ability to upgrade devices using either AT&T Next or T-Mobile Jump and so forth has levelled the playing field in terms of device availability, buying and pricing.

- This means the carriers with more aggressive value plans will attract more smartphone users than ever before from the rival networks though the network coverage and quality will still remain one of the crucial factors for many.

- CDMA carriers such as Verizon, Sprint might also start accepting BYOD (Bring Your own Device) to their network especially those models which are global world mode models and compatible to their networks. This means an opportunity for LG to build base in open and unlocked market.

- At the end of Q2 2015, more than 50 million subscribers in USA on the top four carriers were on EIPs:

- AT&T: 21.0M (37% of postpaid)

- VZW: 14.0M (13% of postpaid)

- TMO: 11.3M (38% of postpaid)

- SPT: 4.5M (15% of postpaid)

Among price, brand, function etc, which one is key factor for buying?

- Move to EIP will drive sales of premium phones sold by carriers more than before as the cost will be sucked into the monthly installment and will be mostly invisible when coupled with cheaper value plans

- Further, we would see ‘device leasing’ trend continue to emerge as replacement cycle is now controlled by and in the hands of consumers rather than the carriers and thus has opportunity to upgrade to a newer model faster than ever before

- The another trend we could see is “affordable premium” unlocked phones being launched which can work across all US carriers e.g. Moto X Pure Edition which many mature consumers would opt for

- The key factors which consumers look for is: design vs price as smartphone users get more mature – though this is true only for Android consumers as Apple iPhone users are more aligned to and prefer the Apple brand, design and ecosystem

With advent and growth of more cost-competitive other Asian players (e.g. Xiaomi. Asus, Alcatel, ZTE, LeTV and so forth) in US market in future, we see these brands will lower the bar for pricing of the same spec premium phone which LG or Samsung would price at roughly $100 to $200 higher

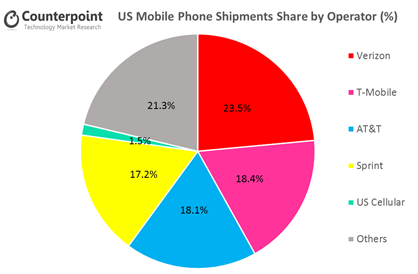

The change of market share for operators

According to our latest Q2 2015 operator share numbers, T-Mobile platform (including MetroPCS) shipped and activated more mobile phones than AT&T and now is the number 2 carrier in terms of device sales.

Conclusion

- Apple is still immune to this trend due to availability across all the carriers, healthy home market demand, maturing Apple user base as well as selling almost all-carrier compatible ready unlocked iPhones through its own channels

- Android brands such as LG & Samsung will have to gain stronger shelf space at T-Mobile as well as in the unlocked market to capitalize on the trend

- LG is already showing strong momentum in prepaid segment alongside ZTE and Alcatel taking share away from Kyocera and Samsung but slower in unlocked market which could grow from 5% to 10% next year

- Samsung is the most hurt here by losing share to almost everyone – to Apple in premium, to LG & ZTE in mid-tier and Alcatel in low-tier especially feature phones

– Neil Shah