Hot on its heels after the announcement of its new flagship BlackBerry Passport, BlackBerry also announced its fiscal Q2 2015 (June-Aug 2014) quarter performance results. The results continues to be challenging as the company tries to figures out how it can align its core competency which is software engineering, mobile and enterprise services and security along with strategy. If this resonates well then BlackBerry could be on a path to make a comeback and find a successful position to remain prevalent in the mobility space and beyond.

Let’s look at the key performance indicators trends to analyze the underlying trends, challenges and opportunities for BlackBerry:

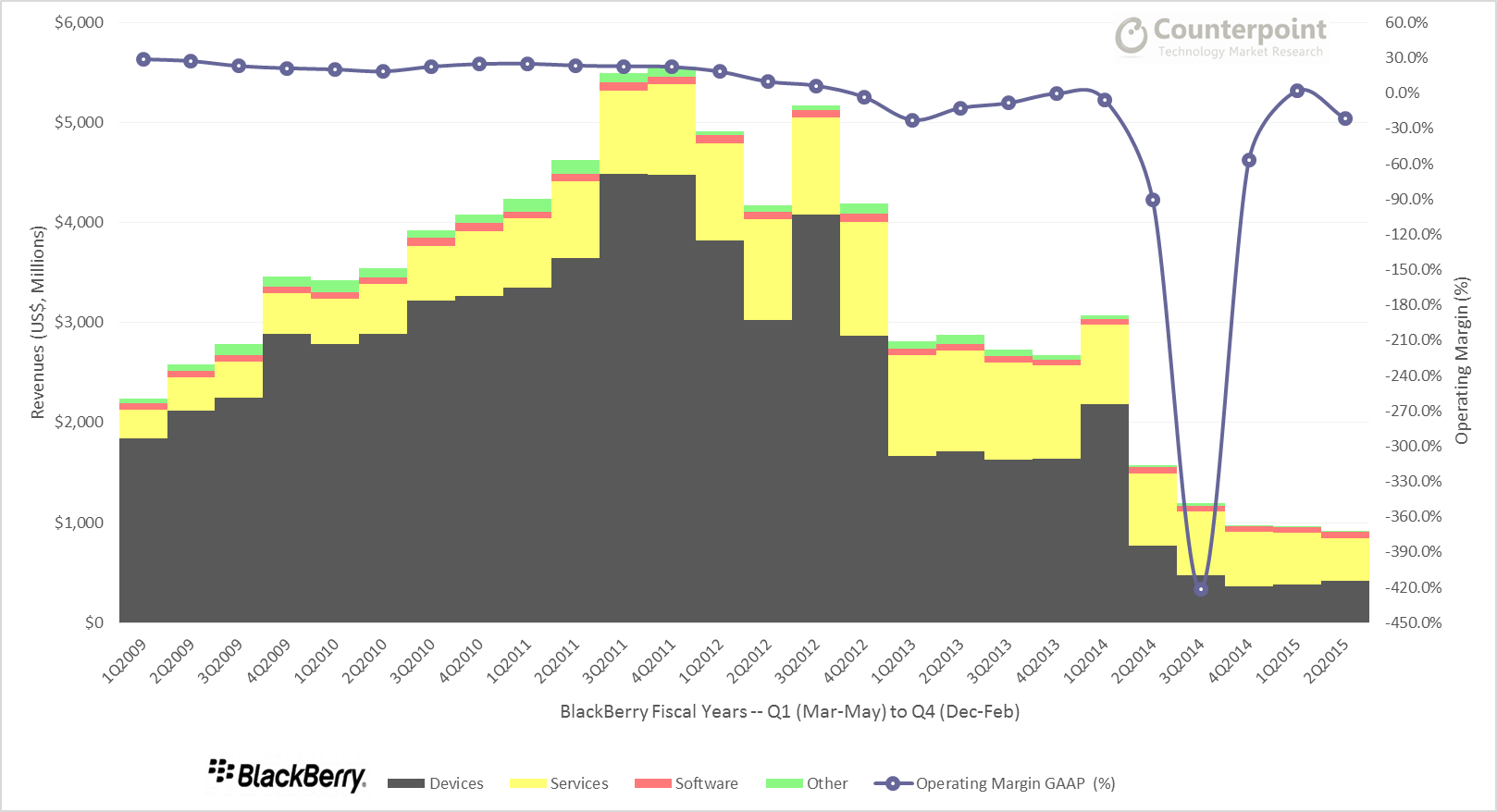

- During the latest August 2014 ending quarter, BlackBerry’s total revenues hit an all-time-low of US$916 million down 42% annually and now is down to almost a fifth of the total revenues generated at its peak during its fiscal Q4 2011 (Dec-Feb) quarter

- While majority of the service revenues for BlackBerry are intertwined with the hardware sold or in use, the declining shipments and eroding installed base have been the key reasons for the overall revenues to dip to an all-tine low

- The revenue mix has tilted more towards software, services and IP licensing which contributes to more than 50% of the revenues compared to 19% at its peak

- While the profitability has been improving with kudos to John Chen and team on the restructuring efforts but the company will need more scale to move out of red and maintain profitable

- The demand for BlackBerry hardware has dwindled in wake of tough competition from Android, iOS and now Windows Phone in consumer as well as enterprise arena

Exhibit 1: BlackBerry Revenue Mix and Operating Margin Trends

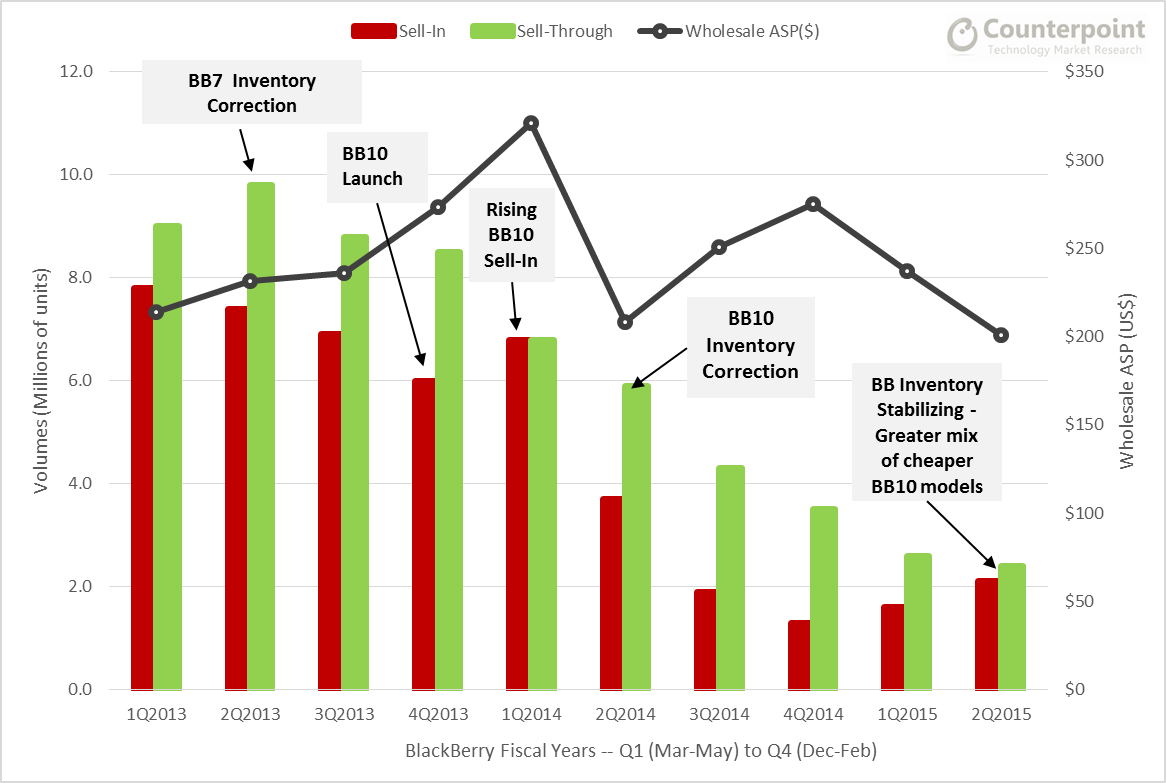

- Since the launch of BlackBerry 10 platform in January 2013, we have seen how the hardware mix has shifted and eventually declined with demand remaining softer than what BlackBerry expected

- BlackBerry erred on the BB10 devices launch with illogically high pricing providing very little opportunity for its core users (mostly in $400 below price bands) and others to adopt the devices with an unproven platform open arms

- It was too late in the game with the launch of actual price-competitive devices such as Q5 or Z3, the price-bands which they should have launched from the word go

- Following is the sell-in and sell-through trend for BlackBerry devices which clearly shows the demand-supply gaps over the time and harsh corrective actions BlackBerry had to adopt to reach a steady state

Exhibit 2: BlackBerry smartphones Sell-in vs Sell-Through Volume Trends

Source: BlackBerry Fiscal Results – (BlackBerry reported sell-in & sell-through data)

- Though we believe BlackBerry 10 is a robust platform in terms of performance sporting a modern and slick interface and bundled with gold standard enterprise security, communication software and services but the lack of native apps and momentum has been holding the platform back.

- Android apps (e.g. Amazon App store) and services compatibility on the BB10 platform doesn’t do justice and the overall performance, UX is inferior compared to the natively designed apps and services

- While enterprise still remain the strong segment for BlackBerry devices (though BYOD is hurting), the consumer traction is weak and the positioning for the devices, platform remains to be ambiguous and in a quandary

As highlighted in our previous post, we believe it is high time that BlackBerry focuses on its core assets, competencies and pivot as Nokia is doing successfully by becoming a more operationally efficient software, services and platform player in the tech industry with HERE, NSN and Advanced Technologies units.

Opportunities:

BBM

- Opening up BBM to multiple platforms going horizontal is a good step in the right direction. BBM is now available across all the four major platforms: Android, iOS, Windows Phone and BlackBerry

- Since going horizontal, BBM user registrations has climbed up to more than 170 million users with roughly 91 million Monthly Active Users (MAUs)

- BBM channels is another great addition to enable a communication platform for brands, artists, businesses and communities as well which could transform (BBM Money) into a much broader and the most secure m-commerce platform along the lines of WeChat, a big opportunity for BlackBerry

- eBBM is another great move by BlackBerry to enable enterprise grade secure messaging solution. the key component of eBBM suite being the BBM Protected security model which uses the FIPS 140-2 validated cryptographic library enabling secure communication intra- and inter-company employees even not on the same BES Servers. It should be an ideal for the government, financial, healthcare and insurance sector customers

- BlackBerry expects BBM to generate $100 million in revenues in fiscal 2016 and we believe BlackBerry if it plays it cards and positioning right, BBM could become one of the top communication/commerce platforms globally as consumers start get twitchy from privacy & Security perspective with players such as Facebook or Google start dominating the messaging platforms

- The next logical step for BlackBerry would be to invest in data analytics capability to mine, analyze the millions of data points flowing through the BBM service but unlike Google or Facebook use it to improve the user experience

QNX / Project ion / Verticals

- Building a secure QNX based platform to power the IoT applications and experiences, another big “platform” based opportunity

- In automotive arena, BlackBerry already has some traction with QNX platform to power auto Infotainment systems, smarter driving, ADAS and more and could definitely make an impact in the next generation connected car space leveraging its mobile heritage

- QNX architecture has also been widely used and find potential in other verticals such as industrial automation, medical, defense, etc and should continue to leverage opportunity to power secure applications, devices and enterprises going further horizontal as a platform player and build scale

Enterprise

- BlackBerry has been losing the hold on enterprise as its devices installed base is being swiftly eroded by competing platforms’ including more secure enterprise friendly features in addition to proliferation of competing MDM solutions such as AirWatch, Good or MobileIron to manage the competing BYOD influx

- However, we still believe BlackBerry is still a gold standard in terms of enterprise mobility management (EMM) solutions and with still a sizable lead, reach and scale, though acquiring players such as Good or AirWatch could accelerate share in enterprise

- There are more than 30k+ BES servers installed globally across 170+ countries and hundreds of carriers

- The upcoming cloud-based BES 12 should help BlackBerry scale the solutions and servicesin a faster and agile way extending EMM including not only leading mobile platforms but also IoT management, a big advantage for BlackBerry

- BlackBerry’s EZPass program has already won 3500+ enterprise accounts tripling to 3.4 million client access licenses (CAL) for its platform in a quarter migrating them to BES 10

- This is going to be an space to watch over the next twelve as BlackBerry re-innovates and marks a comeback with more comprehensive EMM solutions till date to challenge the competition

To summarize, BlackBerry is at a point where it has to realign resources and focus more on to become a platform, software and services company rather than continue to pursue bigger ambitions in hardware space from long-term perspective. Furthermore, becoming a full blown horizontal platform, software and services company, BlackBerry will also need to invest in big data analytics space to be relevant in the Big information era. However, BlackBerry can chose to remain a “premium” niche player to offer the most secure devices ever and the company can grow over time with a controlled (limited SKUs with focused segmentation) organic growth in hardware space. To achieve the same, BlackBerry will need its devices to include world-class differentiated design, apps, services and a novel way to re-position them in consumers and customers’ minds. We think BlackBerry Passport is a step in the right direction and there is an opportunity in premium smartphone space to exploit with Apple controlling lion share of the market now.

Neil Shah

@neiltwitz