Southeast Asia holds great potential for growth in the technology and e-commerce sectors. It has a comparatively young and tech-savvy demographic which is experiencing a digital transformation jumpstarted by the COVID-19 pandemic. Even 5G commercialization is being pushed in most of the region’s key countries.

Overall, the US, EU and Japan remain the key investors in Southeast Asia. But this might change with China’s renewed focus on the region. The country has been investing in Southeast Asia across sectors for more than a decade now, with infrastructure projects traditionally bagging more funds. However, China’s influence in the region has increased after the start of its trade tussle with the US. Critical sectors like electricity and telecommunications are now being backed by Chinese investors.

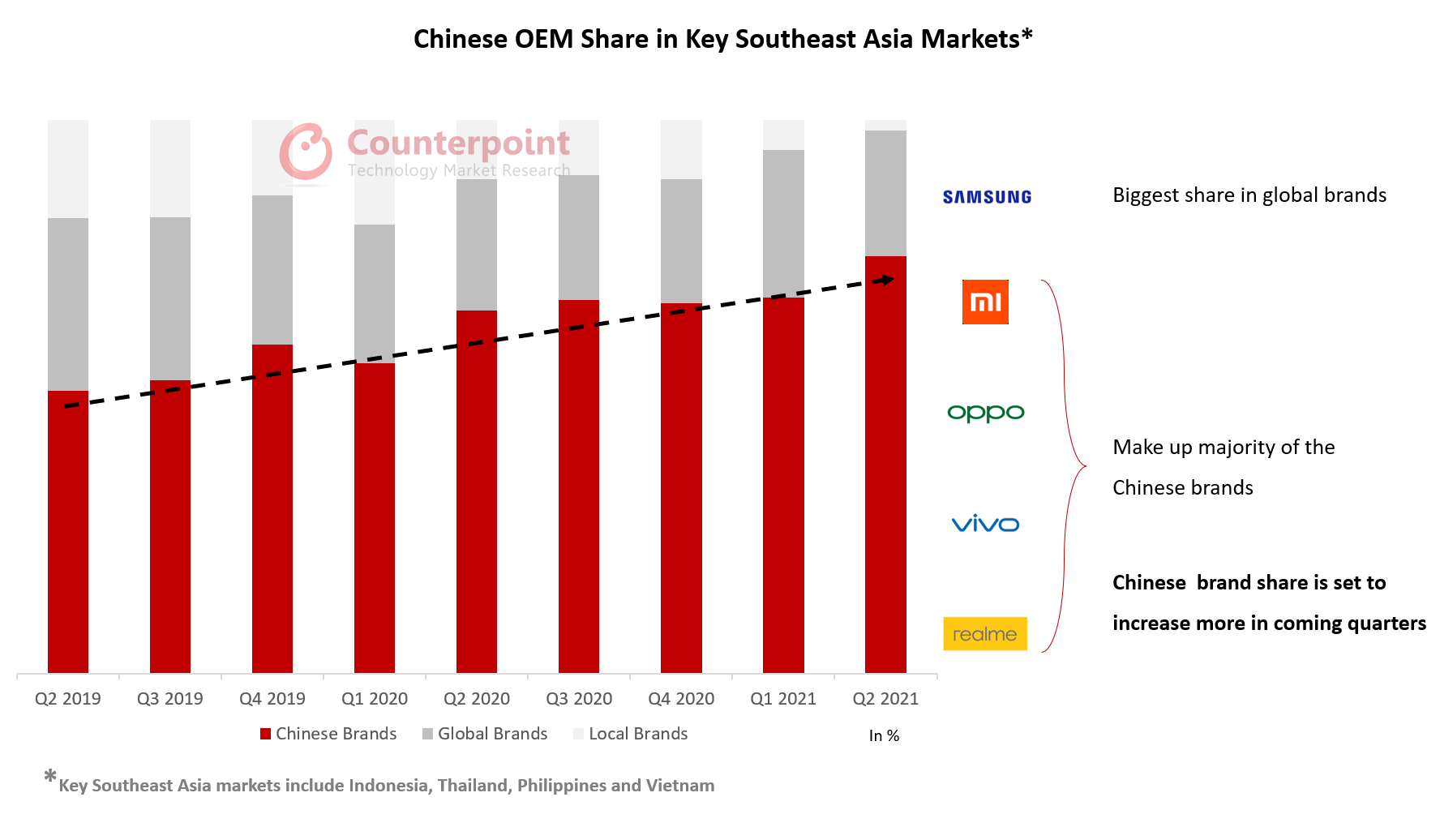

The region’s smartphone landscape went through some volatility after COVID-19. This is when Chinese smartphone OEMs started pulling share from Samsung. Their smartphone share in Southeast Asia has made up a majority for more than a year now. It has increased substantially over the last few quarters. In Q2 2021, main Chinese OEMs made up 75% of the total smartphone shipments.

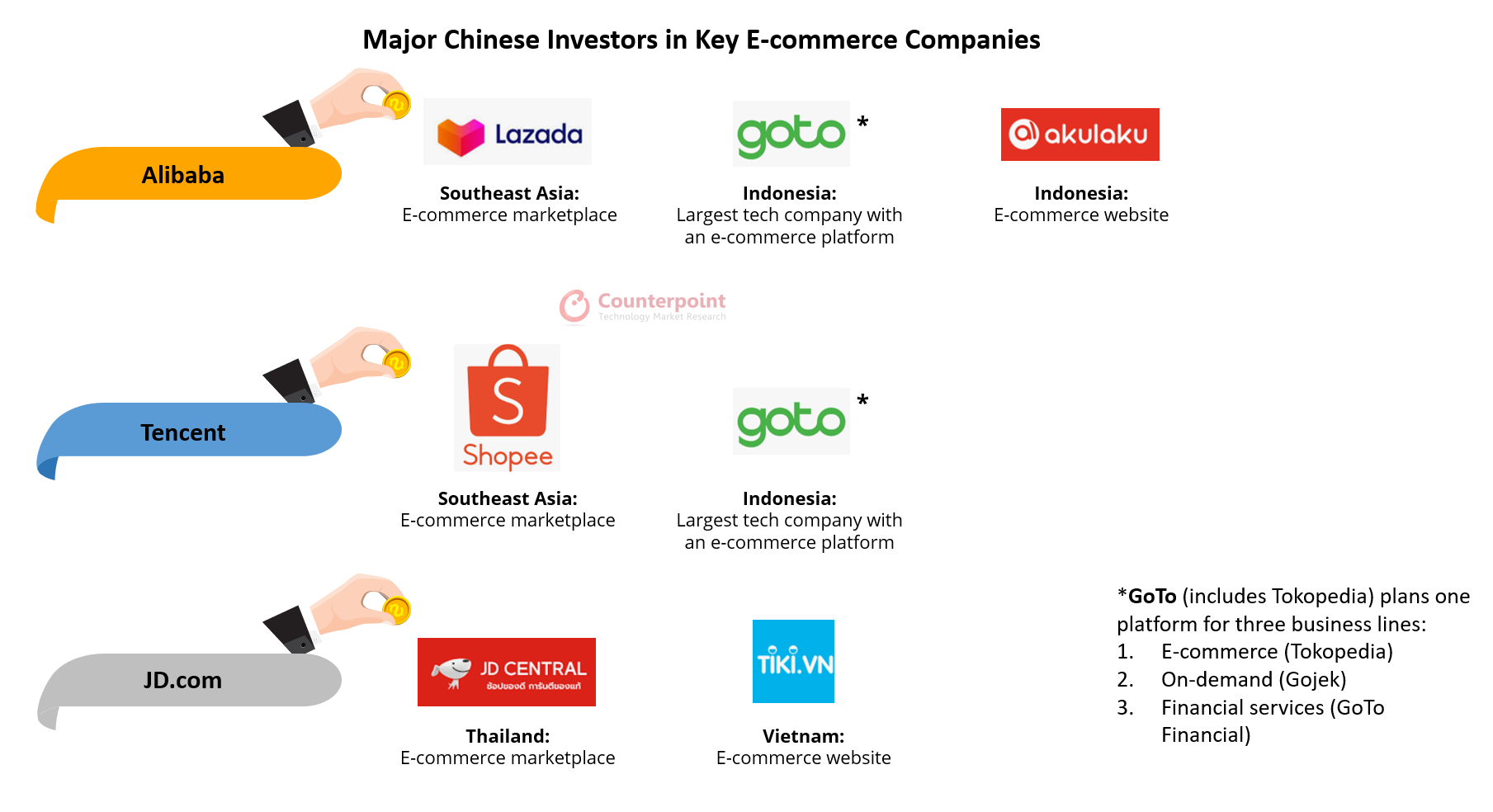

E-commerce initiatives by Chinese players

Chinese investors have been increasing their stake in the region’s e-commerce companies for some time now. Since 2017, e-commerce has been the avenue of interest for Chinese investment due to its growth potential and near-absence of any geopolitical challenge for China in the region. JD.com, Alibaba and Tencent were among the first Chinese investors to pump capital into e-commerce in this region.

5G initiatives by Chinese players

Some countries in the region depend on Chinese technology and know-how. Indonesia has been dependent on Huawei’s 5G technology for more than a year now. The Philippines depends on Chinese telecom infrastructure know-how. In Thailand, Huawei has an active investment in 5G infrastructure. ZTE is another Chinese player with an active role in digital connectivity in the region. These three countries will look to reduce their overall dependence on Chinese tech in the coming months. Currently, however, their goals are focused on 5G development from an economic standpoint. Some countries like Malaysia and Vietnam have given Chinese 5G assistance the cold shoulder.

5G represents a leap in technological growth and overall data sharing. This is an important factor for Southeast Asian countries to consider while partnering with China. Also, such decisions have the potential to become national security issues.

Many major telecom operators in Southeast Asia are lagging in 5G as they still need to recuperate from heavy 4G investments. This is also an area where Chinese capital plays a big part. In contrast, major Chinese smartphone OEMs are ready with 5G devices.

Manufacturing

Since some of the region’s countries are global manufacturing hubs (especially Vietnam and Indonesia), Chinese players will look to diversify their own production facilities. As production capacities shift out of China, these OEMs will aim at buying a stake in the region from a production and assembly point of view. The absence of geopolitical issues and growth potential of the region will serve as motivations for these players.

The Chinese influence is currently strong in the region but so are the investments from US behemoths like Microsoft and Google. Southeast Asia will continue to see an influx of funding in the coming years as this region is set to witness an improved economic climate, enhanced industrial system and increased maturity of consumers with respect to tech.