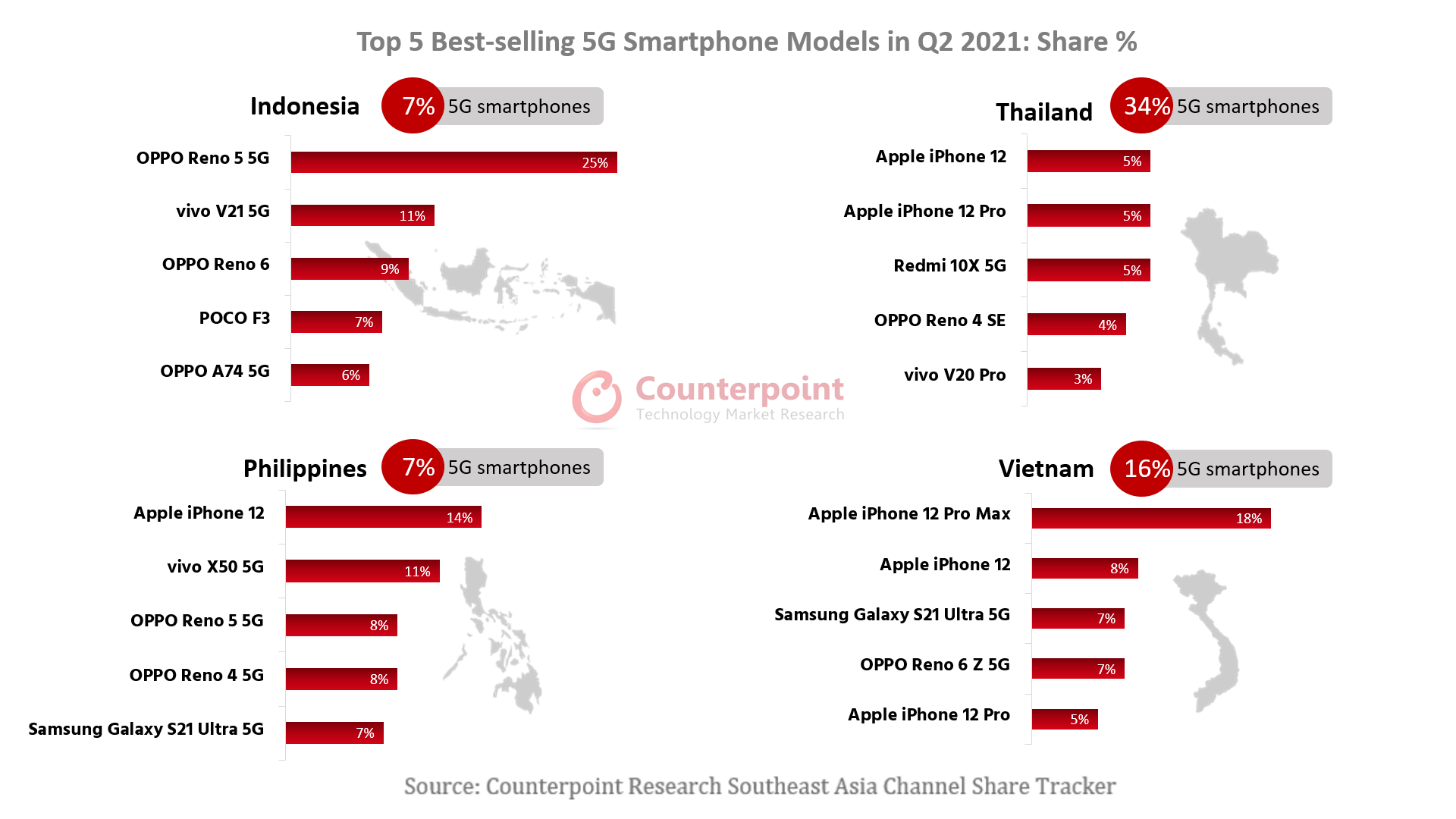

Apple and OPPO’s 5G smartphones topped the best-selling 5G models’ lists in key Southeast Asian (SEA) countries in Q2 2021, according to Counterpoint Research’s Global Smartphone Channel Share Tracker. The aspirational value of Apple and the 5G factor of the iPhone 12 series helped the brand maintain its volumes in the second quarter. OPPO’s Reno 5G series has been performing well in most SEA countries owing to strategic marketing campaigns and consistent discount offers from the brand.

Commenting on the 5G status in the SEA, Senior Research Analyst Glen Cardoza said, “Q2 2021 saw the SEA region recuperate from COVID-19 before running into a fresh outbreak in Q3 2021. During this time, OEMs focused on 5G smartphone shipments. Besides, consistent efforts were made by governments and operators in these countries to grow their 5G infrastructure. Key brands like Samsung, OPPO, vivo and Xiaomi increased their 5G share and brought 5G models in the mid-tier as well. The iPhone 12 shipments saw a gradual dip but still managed to have a sizable portion in 5G, especially in markets like Thailand and Vietnam. Xiaomi’s increasing footprint in the SEA is being noticed by the competition and this will show in the 5G models being launched in the next few months. The coming months will see brands like realme push 5G ASPs lower.”

In 2021, all key countries in the SEA have been focused on developing and improving their 5G infrastructure:

Indonesia:

Major operators like Telkomsel and Indosat have their 5G presence in the main cities while others are building on their capabilities as well. The coverage, however, will be limited in 2021. Current 5G networks are offered with 1.8GHz and 2.3GHz bands. Samsung and POCO are currently selling mid- to low-end 5G models while realme is making its mark with the realme 8 series. This country will see its most 5G volumes in the coming months due to the growing consumer base.

Thailand:

5G commercialization and adoption in Thailand has been the fastest in the region, with all 77 provinces being covered by 5G. Smart cities and industrial applications are being pursued. Apple has a much higher representation here, which boosts the 5G share even more. The launch of the iPhone 13 series will only motivate consumers to opt for the latest technology accompanying 5G. With a growing e-commerce footprint, even Tier II and Tier III towns are upgrading to 5G through brands like OPPO, Xiaomi and Samsung. Operators like AIS, TRUE and Dtac are also providing 5G smartphones through their packages.

Philippines:

A growing middle class even outside Metro Manila is increasing consumer interest in 5G. The country’s 5G commercialization is being led by main operators like Globe and Smart. OEMs like realme will lead the 5G charge here apart from strong contenders like Apple, OPPO and Samsung.

Vietnam:

The government is eyeing both consumer and enterprise-level applications where 5G can play a pivotal role. Vietnamese consumers are also very inclined to adopt 5G. The country’s three major telecom operators – Viettel, NPT and MobiFone – have already started 5G trials in the country. Ericsson is working with the Vietnamese operators to build 5G infrastructure. The second half of 2021 may see the official launch of 5G services in Vietnam, though it may take a couple of years to have a countrywide 5G network.

Most SEA countries are currently reeling under high COVID-19 infection rates due to the Delta variant. Even while 5G technology is being given a push, lockdowns and other restrictions along with a sustained component shortage will have the most impact on 5G smartphone shipments. But irrespective of the overall volumes, we see the 5G proportion increasing for the region in the coming months.