USA Q4 2016: Q4 Smartphone Rally Closes 2016

San Diego, Buenos Aires, London, New Delhi, Hong Kong, Beijing, Seoul

February 28, 2017

According to the latest research from Counterpoint’s Market Monitor program, the US smartphone market grew a modest 1.1% year on year in 2016. After a slow start to the year, sales gained momentum during the second half of the year. Upgrades and switching grew in the second half, mainly due to the iPhone 7 launch and seasonal increases in promotions during the holidays. During Q4, US smartphone units grew 6.3% YoY.

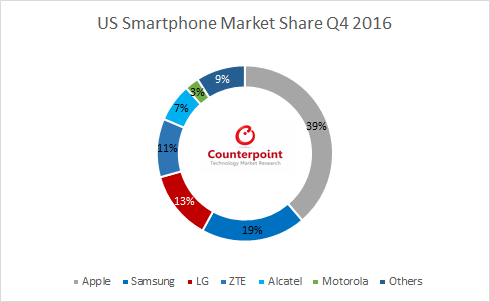

Commenting on vendor performance during the quarter, Counterpoint Research Director Jeff Fieldhack added, “Apple was able to grow its smartphone market share to 38.7% in Q4. And, this is in a climate where US carriers are experiencing elongating upgrade cycles and some carriers seeing lower spending on devices. Apple was able to win record number of Android switchers during the 4th quarter—partially aided by the removal of the Note 7 from the market. The company also has seen further demand shift to the Plus variant as well as higher memory configurations—both helping ASP’s. This shows the base still sees value within the Apple brand when many competitors are driving down costs within the flagship space. This positions Apple well for the Fall refresh.”

Notable Q4 Break-throughs:

Google’s first in-house designed smartphone hit the market. Mr. Fieldhack added, “Google exits Q4 and 2016 with a successful launch of the Pixel & Pixel XL. Despite it being a Verizon exclusive, the device has gained plenty of mindshare. It is possible to purchase the device unlocked to run on other carriers. However, because both Verizon & Google so heavily co-marketed the device branded Verizon, Verizon appears to have been the big winner garnering most of the activations. Volumes would have been much larger had the device not been bogged down by shortages—very likely due to component shortages. Google is straddling a fine line selling competing hardware with its customers. However, the Pixel is a nice vehicle for the company to showcase its Android & AR aspirations. Google wants to be more opinionated about design and push experiences forward where it believes OEM partners have not been willing or able.”

Chinese vendors ZTE & Alcatel continued to grow and build their brand during 2016. ZTE eclipsed double digit smartphone market share growing to 10.7%. The company took advantage of the growing prepaid channels of MetroPCS and Cricket with its affordable phablet smartphones. Alcatel was able to grow its smartphone shipments by 84% during the year, much of the growth attributed to launching in new carrier channels.

For Samsung, it was all about minimizing losses. Counterpoint Research Analyst Archana Srinivasan comments, “Samsung lost 5% smartphone share during the quarter, but considering it had its highly-acclaimed Note 7 pulled from the market, the company nicely limited losses. Promos were shifted to GS7 and Edge. Credit R&D teams from Samsung that the device remains so competitive and, in fact, remains the only Gigabit LTE ready device in the US market. Also helping to reduce losses was the success of the J-series, which had a great quarter within both prepaid and postpaid channels. Samsung continues to reap the benefits of the halo effect in the US that the Galaxy flagship has produced for the rest of the portfolio.”

Carrier channels becoming more competitive in 2017

T-Mobile continued its dominance in capturing 933k or 68% of phone net adds during Q4. Ms. Srinivasan adds, “However, 2017 looks to be a more competitive year as all carriers have returned to offering unlimited data plans. The expectation that cable MVNO’s will enter the market will also accelerate competition. With 75% of subscribers now on non-subsidized pricing, look for aggressive switch offers to continue at a higher pace in 2017 than 2016. This will benefit flagships and OEMs willing to aggressively share marketing costs with carriers.”

Within prepaid channels, AT&T and T-Mobile remain by far the strongest channels with the performances of the Cricket and MetroPCS brands. Between the two, they added ~950k subscribers. Verizon, despite making small competitive pricing changes to prepaid, remains on the sidelines. The company remains content focusing on premium postpaid subs as it lost 10k prepaid subs during the quarter. Sprint continues to shake up their prepaid brands and is implementing its plan to tighten its reporting on low engagement subs. The changes are expected to reduce their prepaid subscribers by 2m prepaid subs by year end. The Tracfone channel has also weakened through 2016.

The Big 4 carriers saw smartphone activations decrease 1% YoY during Q4. Verizon and Sprint witnessed small 2% and 2.7% gains. T-Mobile activated 100k or 1% less smartphones. AT&T had a 7.6% decline in smartphone activations in 4Q16, but the company noted a growing BYOD trend.

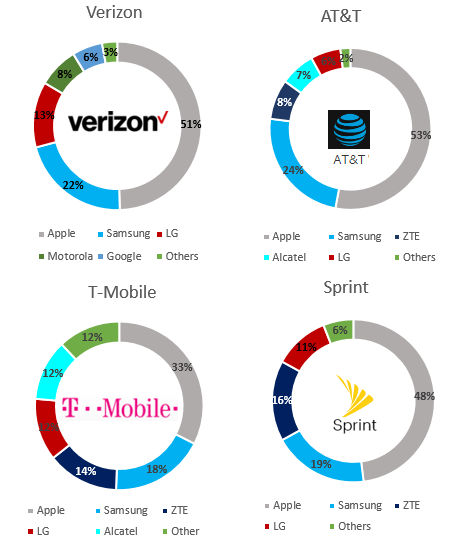

Within carrier channels, OEM shares did not see dramatic year on year changes. Apple gained incremental share in all Tier 1 carriers. ZTE also witnessed share gains in AT&T and Sprint–much of the gains because of ZTE Grand X3 and ZTE Quest.

There was an increase of sales of >$200 Android smartphones—a trend expected to continue. Chief benefactors during the quarter were Samsung J-series, LG K-series, and ZTE. Low-cost Android devices also grew on the strength of national retailers BestBuy & Walmart, as well as sales within the Amazon channel.

US Smartphone share by carrier – Q4 2016

The comprehensive and in-depth Q4 2016 Market Monitor is available for subscribing clients (here). Please feel free to contact us at press@counterpointresearch.com for further questions regarding our in-depth latest research, insights or press enquiries.

The Market Monitor research is based on sell-in (shipments) estimates based on vendor’s IR results, vendor polling triangulated with sell-through (sales), supply chain checks and secondary research.

Background:

Counterpoint Technology Market Research is a global research firm specializing in detailed industry analysis of the TMT sectors. It services major technology firms and financial firms with a mix of monthly reports, customized projects and detailed analysis of the mobile and technology markets. Its key analysts are experts in the industry with an average tenure of over 15 years in high tech industries.

Analyst Contacts:

Jeff Fieldhack

+1 858.603.2703

jeff@counterpointresearch.com

Archana Srinivasan

+1 703.459.7889

archana@counterpointresearch.com

Neil Shah

+91 9930218469

neil@counterpointresearch.com

Follow Counterpoint Research

info@counterpointresearch.com