Every month we track the smartphone market across 35 countries from the supply chain to the retail POS and consumers to create accurate data and ultimately reveal the real sound of the market apart from the clutter our clients suffer from.

The overall Q2 2014 market is weak and larger vendors seem to suffer more than the smaller weaker ones. Below are the key takeaways from our regular Market Pulse report of May 2014.

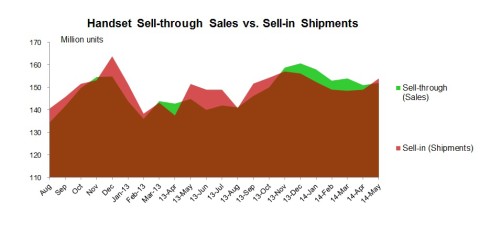

1. The Market: In May handset sell through improved only slightly. Demand is getting better. Europe and the Emerging Markets improved but China is still slow and continues to contract. Japan and Korea are also weak although better than April. Sell-in shipments also followed the rise in sell-through sales demand. Q2 2014 is likely to be better than expected; potentially almost equal to shipments in Q1 2014.

Inventory at the industry level remain at manageable levels in most countries. Smartphones are now 69% of the market.

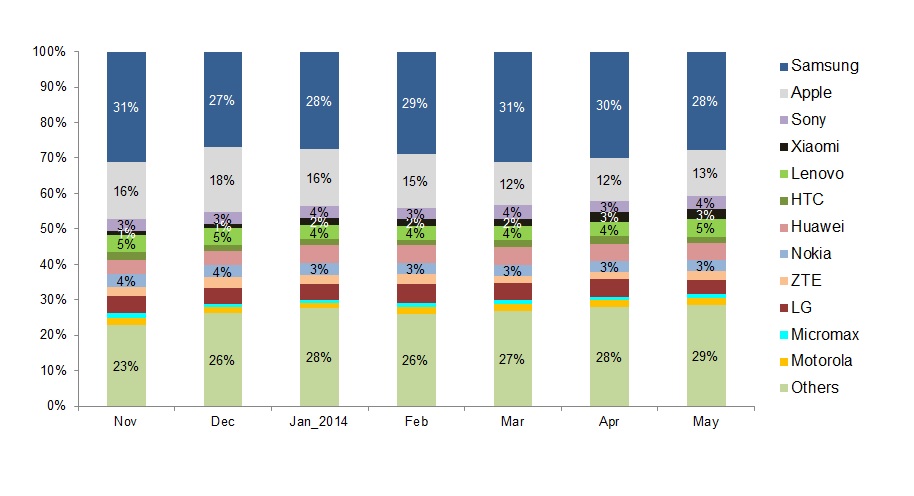

2. Vendors: Most international brands did not see improvement in sales – especially Samsung. Samsung still leads in all price bands and regions but loses share everywhere, all price bands and most regions including China and USA. Apple gains in the US. Both Lenovo and Motorola enjoy growth. Mostly Emerging market local vendors (or local kings) take share from Samsung. See our report on Pakistan and Qmobile at www.counterpointdb.com. Apple’s sales rebounded in the US due to changes in operator plans and deals. Lenovo has gained share with new models and Motorola is showing good momentum since its Moto G launch.

APAC accounted for the majority of Samsung’s sales and China contributes the most among countries, followed by US and India. The newly launched Galaxy S5 was the best selling handset in May but the “not-quite-sexy-enough” premium Galaxy S5 which seems to have peaked at 5 million units a month. The mid-low tier smartphones are also suffering as there aren’t new models. LG’s G3 effect is not showing yet but we expect it to kick-in starting from late June. Xiaomi sales in China started to fall as the flagship models grow old.

Smartphone market share by each month 2014

3. Price-band analysis: The share of sales in the $400+ price bands (ASP or transfer prices) fell as the mix of local smartphone brands strengthened further. Emerging markets were also strong although China was weaker than expected. In May month 56% of global Android devices were under $200 a 1pp increase from April.

4. Hardware Features: Handset features have shifted more toward larger 5inch+ displays, which comprised 45% of all smartphones sold. In May, LTE could be found in 35% of the total smartphones sold. Samsung leads the LTE market with 38% share; followed by Apple with 29% of share; rest of the market was highly fragmented. LG left Sony behind and stood at 3rd position in May (last month it was 4th) but the Chinese are growing fast especially Huawei and Coolpad.